Afternoon train reading: • Are You A Born Investor? (Psy-Fi Tech) • The Man Who Busted the ‘Banksters’ (Smithsonian Mag) •...

Afternoon train reading: • Are You A Born Investor? (Psy-Fi Tech) • The Man Who Busted the ‘Banksters’ (Smithsonian Mag) •...

Read More

~~~ Source: Fact or Fiction: Is the Consumer Back? Stacy Curtin Daily Ticker

Read More

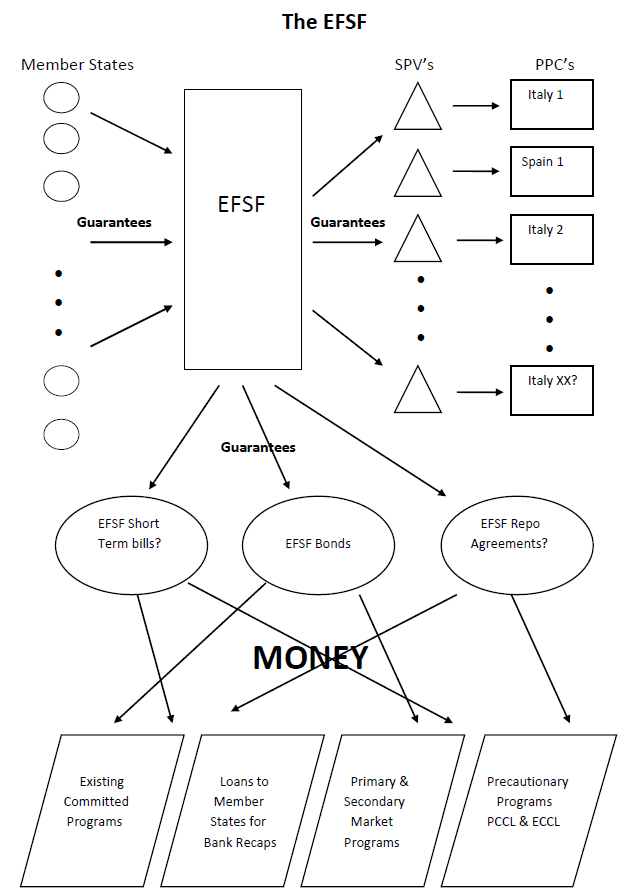

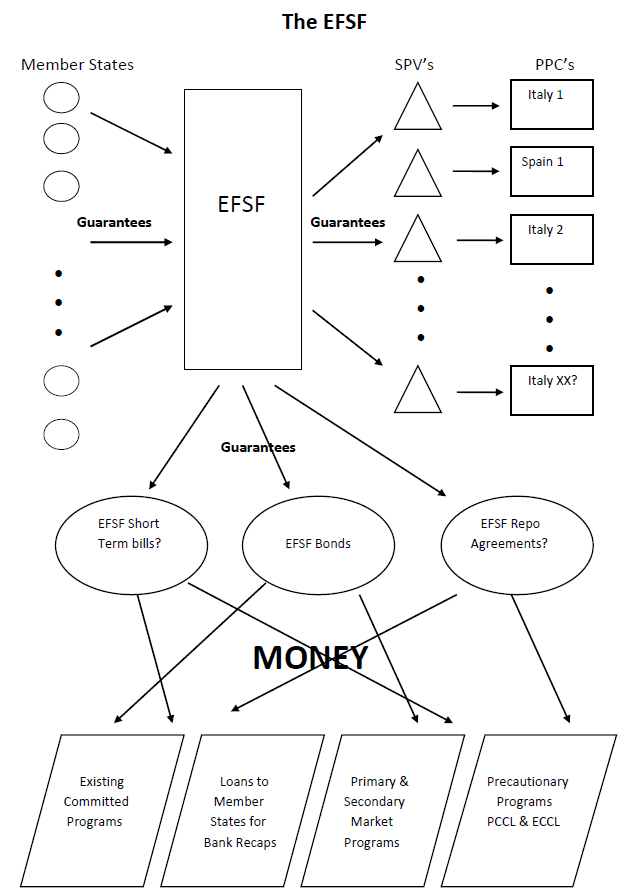

Peter Tchir started TF Market Advisors in 2011 as a platform to trade marketable securities as well as provide expert market information....

Peter Tchir started TF Market Advisors in 2011 as a platform to trade marketable securities as well as provide expert market information....

Read More

It looks as if Mrs Merkel is trying to neuter the German Constitutional court on matters relating to the euro zone financial issues...

Read More

Keith and “Countdown” contributor Matt Taibbi of Rolling Stone discuss the remarkable decision by U.S. District Judge Jed Rakoff to...

Read More

Likely confirming QE3 on Dec 13th when the FOMC next meets, Fed Gov Yellen, part of the Bernanke, Dudley trio said while the “Fed...

Read More

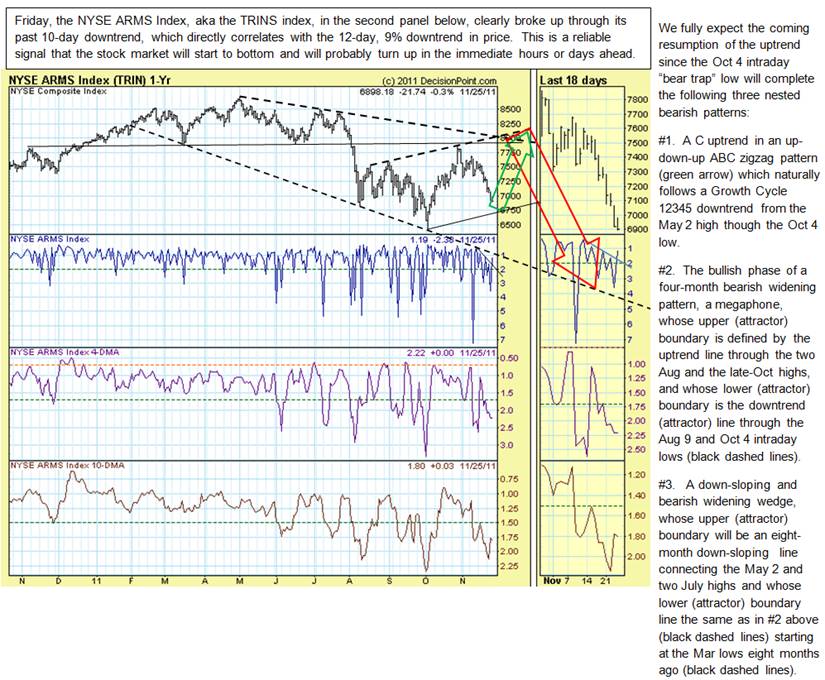

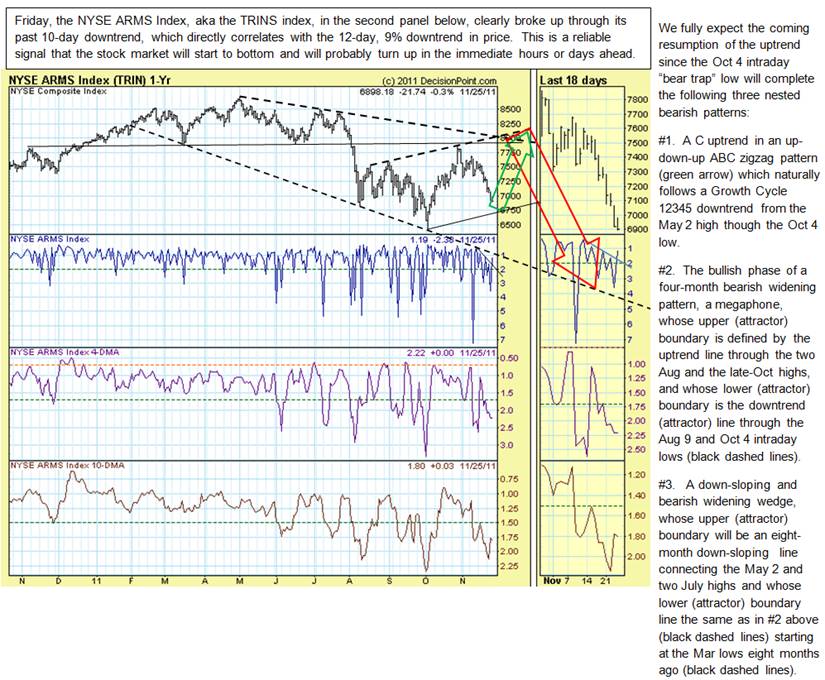

November 27, 2011: The short term (weeks) bullish setup of several technical patterns, which are annotated in the first chart below is...

November 27, 2011: The short term (weeks) bullish setup of several technical patterns, which are annotated in the first chart below is...

Read More

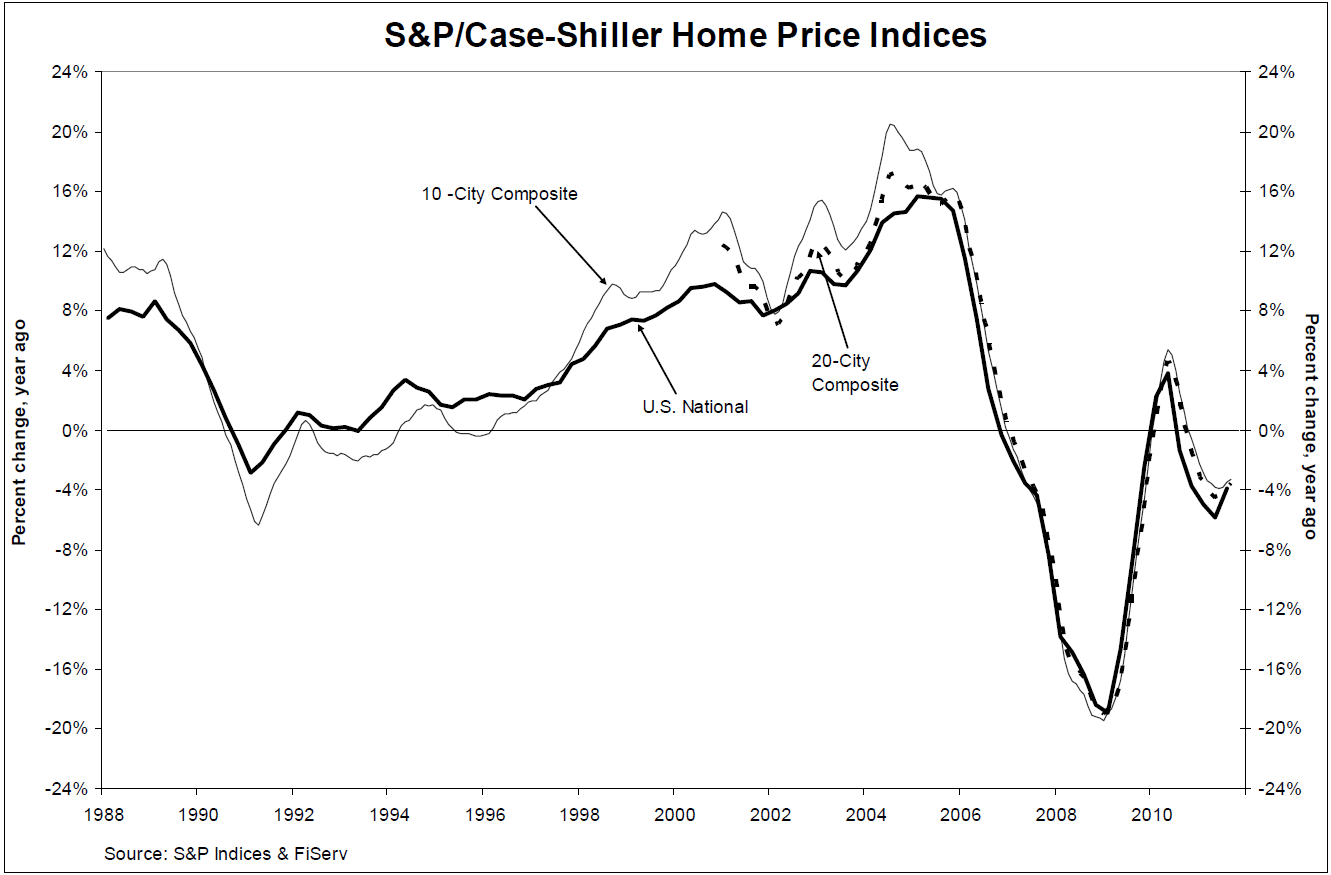

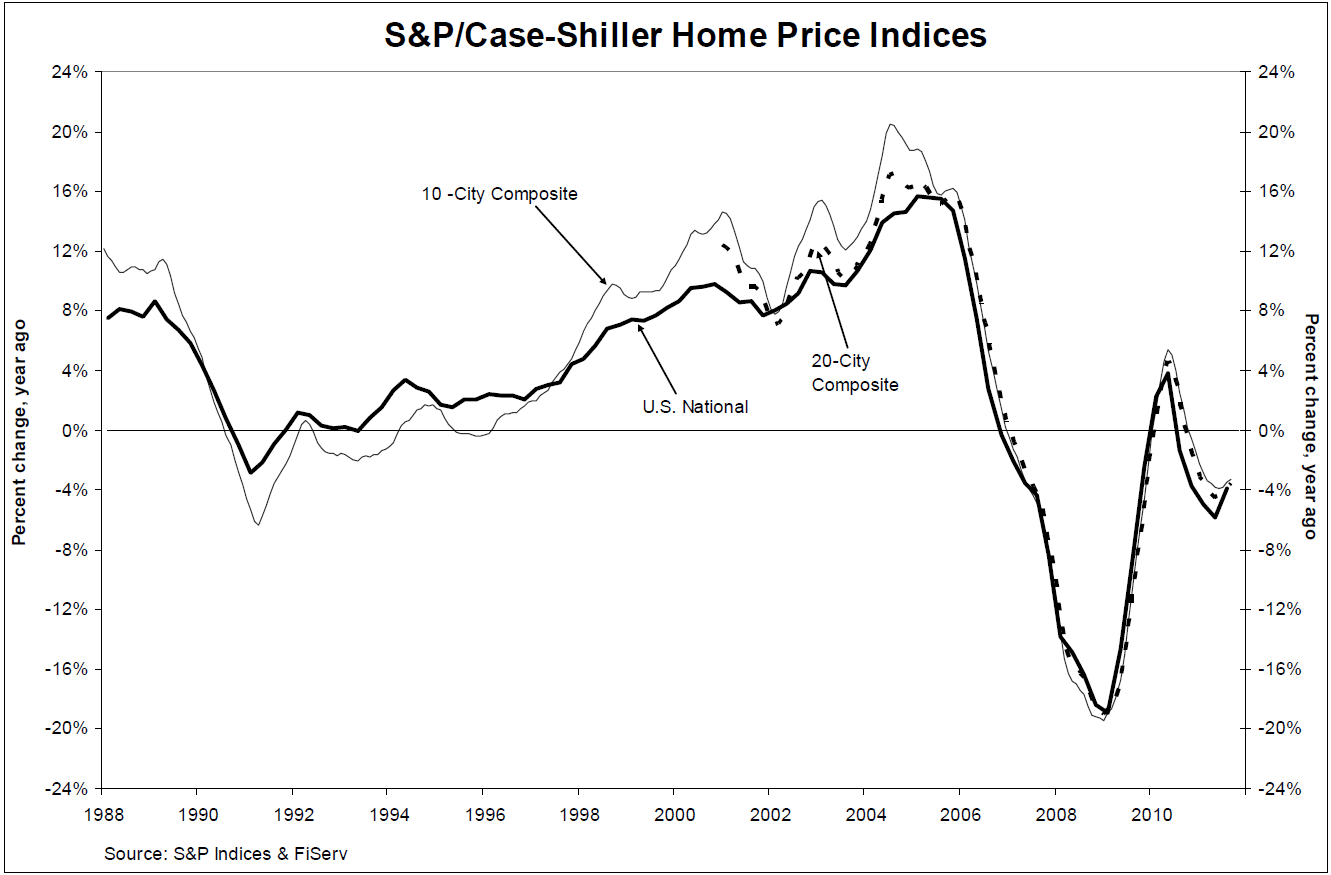

The data point of note is that “the national index posted an annual decline of 3.9%, an improvement over the 5.8% decline posted in...

The data point of note is that “the national index posted an annual decline of 3.9%, an improvement over the 5.8% decline posted in...

Read More

John Taylor, founder, chairman and chief executive officer of FX Concepts LLC, talks about the outlook for the euro and the European...

Read More

Consumer Confidence in Nov at 56 as measured by the Conference Board was well above expectations of 44 and up from 40.9 in Oct....

Read More

Afternoon train reading: • Are You A Born Investor? (Psy-Fi Tech) • The Man Who Busted the ‘Banksters’ (Smithsonian Mag) •...

Afternoon train reading: • Are You A Born Investor? (Psy-Fi Tech) • The Man Who Busted the ‘Banksters’ (Smithsonian Mag) •...

Afternoon train reading: • Are You A Born Investor? (Psy-Fi Tech) • The Man Who Busted the ‘Banksters’ (Smithsonian Mag) •...

Afternoon train reading: • Are You A Born Investor? (Psy-Fi Tech) • The Man Who Busted the ‘Banksters’ (Smithsonian Mag) •...