>

My Sunday Business Washington Post column is out. This morning, we look at The Big Lie and the Financial Crisis.

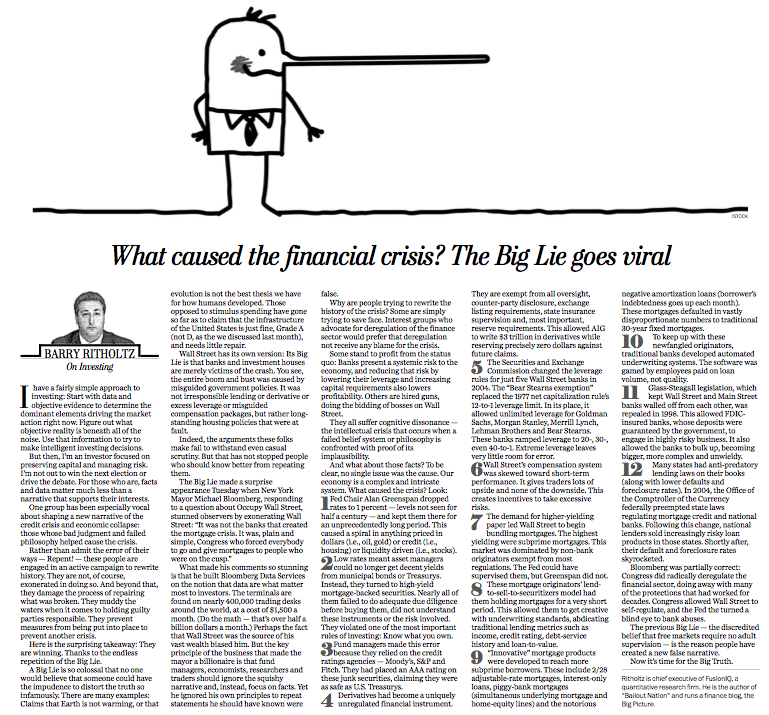

The print and online versions had the same headlines: What caused the financial crisis? The Big Lie goes viral. (You can see the excised bits that did not make it to the final version here).

Regardless, here’s an excerpt from the column:

“A Big Lie is so colossal that no one would believe that someone could have the impudence to distort the truth so infamously. There are many examples: Claims that Earth is not warming, or that evolution is not the best thesis we have for how humans developed. Those opposed to stimulus spending have gone so far as to claim that the infrastructure of the United States is just fine, Grade A (not D, as the we discussed last month), and needs little repair.

Wall Street has its own version: Its Big Lie is that banks and investment houses are merely victims of the crash. You see, the entire boom and bust was caused by misguided government policies. It was not irresponsible lending or derivative or excess leverage or misguided compensation packages, but rather long-standing housing policies that were at fault.”

I like the layout and art work in the dead tree version of the paper:

>

click for ginormous version of print edition

>

>

Source:

What caused the financial crisis? The Big Lie goes viral.

Barry Ritholtz

Washington Post, November 5, 2011

http://www.washingtonpost.com/business/url.html

What's been said:

Discussions found on the web: