Some interesting reading material to end your week:

• Advice from a financial insider: Spend on season tickets, treasury bills, and charity auctions, not $20M for 4% of the Mets (Mets Online)

• Fed May Signal Low Rates Into 2014 (WSJ) see also Fed’s Once-Secret Data Released to Public (Bloomberg)

• Tough year: Finance on the Ropes (Businessweek)

• Retailers Are Slashing Prices Ahead of Holiday (NYT) see also Retailers Try to Thwart Price Apps (WSJ)

• Congress’s Inside Dope for Investors (Columbia Journalism Review)

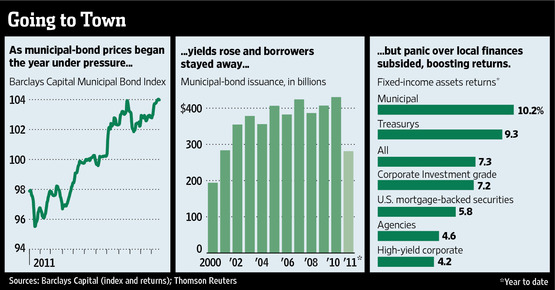

• Muni Bonds: A Disaster That Wasn’t (WSJ) see also Here’s Hoping for More Lousy Forecasts in 2012 (Bloomberg)

• It’s Always Sunny in Silicon Valley (Businessweek)

• Debts Go Bad, Then It Gets Worse (WSJ) see also Consumers Cry Foul Over Debt Collectors (WSJ)

• Is America At A Digital Turning Point? (USC Annenberg)

• The Year in Volcanic Activity (The Atlantic)

Who’s left on your shopping list?

>

What Muni Collapse? Is Whitney a One Hit Wonder?

Source: WSJ

What's been said:

Discussions found on the web: