>

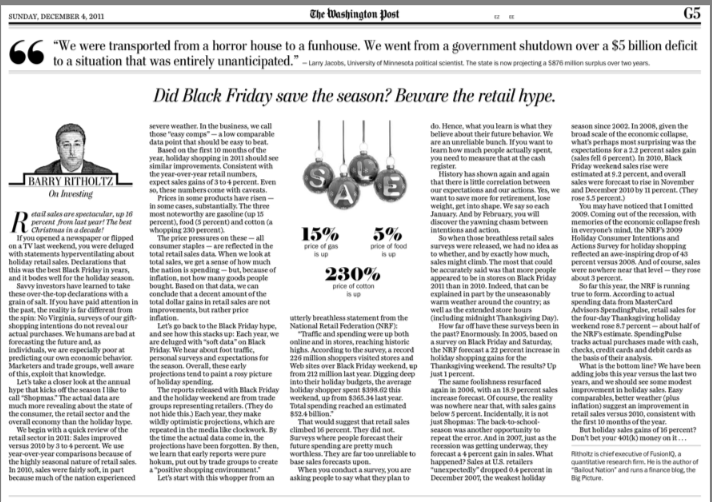

My Sunday Washington Post Business Section column is out. This morning, we look at retail sales, inflation, and forecasts: Did Black Friday save the season? Beware the retail hype.

The key takeaway is that sales improved over last year consistent with the first 10 months of 20121 — but the insane forecasts from the usual trade groups are as they have always been — wildly, exuberantly, too optimistic.

Here’s an excerpt from the column:

“Let’s take a closer look at the annual hype that kicks off the season I like to call “Shopmas.” The actual data are much more revealing about the state of the consumer, the retail sector and the overall economy than the holiday hype.

We begin with a quick review of the retail sector in 2011: Sales improved versus 2010 by 3 to 4 percent. We use year-over-year comparisons because of the highly seasonal nature of retail sales. In 2010, sales were fairly soft, in part because much of the nation experienced severe weather. In the business, we call those “easy comps” — a low comparable data point that should be easy to beat. Based on the first 10 months of the year, holiday shopping in 2011 should see similar improvements. Consistent with the year-over-year retail numbers, expect sales gains of 3 to 4 percent. Even so, these numbers come with caveats.

Prices in some products have risen — in some cases, substantially. The three most noteworthy are gasoline (up 15 percent), food (5 percent) and cotton (a whopping 230 percent). The price pressures on these — all consumer staples — are reflected in the total retail sales data. When we look at total sales, we get a sense of how much the nation is spending — but, because of inflation, not how many goods people bought. Based on that data, we can conclude that a decent amount of the total dollar gains in retail sales are not improvements, but rather price inflation.”

>

My favorite part of the piece is where I compare the past 5 years of Shopmas NRF forecasts versus actual sales. I won’t spoiul the ending, but suffice it to say, hilarity ensues!

>>

click for ginormous version of print edition

>

>

Source:

Did Black Friday save the season? Beware the retail hype.

Barry Ritholtz

Washington Post, December 4, 2011

http://www.washingtonpost.com/business/did-black-friday-save-the-season-beware-the-retail-hype/2011/11/29/gIQAfNCUMO_story.html

WP 12.4.11 Retail (PDF)

What's been said:

Discussions found on the web: