Old joke about Analysts:

You do not need them in a Bull market, and you do not want them in a Bear market.

>

I was thinking about that in light of the S&P’s mass EU downgrade threat.

As always, the Credit Rating Agencies are quite late to the party. And consider that the European Central Bank, whose balance sheets are festooned with bonds from all of these countries, is somehow still AAA.

My bottom line about the rating agencies is they are worthless to investors.

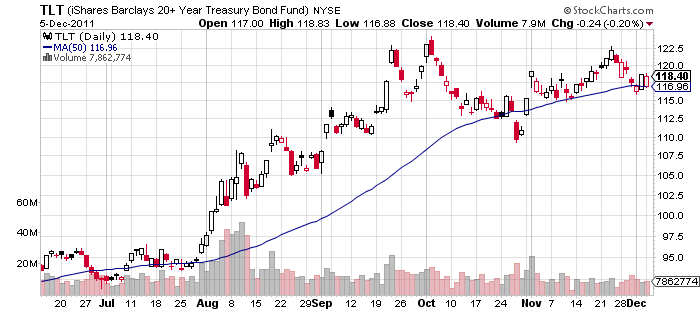

Consider how the market actually reacts to these outlook and ratings downgrades. As an example, think about the downgrade of US debt from AAA to AA+, as the chart below reveals:

>

Spot the Down Grade!

click for larger graphic

Source: Stockcharts

>

As a reminder, the S&P downgrade was August 5th; US Treasuries have actually rallied since, then, sending rates appreciably lower, and making US borrowing costs less expensive. (Thank you sir, may I have another?)

Equity markets wobbled for a few months, then resumed what they were doing previously (going sideways). Last I checked, the Euro was practically flat year to date.

Given the various downgrades, they seem to make a lot more heat than light. They do not seem to matter as much as we think to the markets they are actually rating — namely, debt. Its somewhat ironic that a downgrade of debt seems to have more impact in the equity markets.

Which leads us to telling question: Do the ratings agencies matter anymore? Have investors figured out that they are corrupted, conflicted, unable to honestly discharge their duties?

Or is it simply that they suck at what they do? Recall the downgrades of Enron, Worldcom, Lehman, AIG, and many others. It seems the markets force them to act, that Traders are issuing the call long before the analysts at Moody’s or S&P actually downgrade a corporate or sovereign ratings.

We may not need the judgment of honest analysts in a bull market, or want them in a bear market, but it seems the answer to our headline question: When it comes to the ratings agencies themselves, investors seem to have little if any use for them anytime.

What's been said:

Discussions found on the web: