Facinating piece from SocGen’s Cross Asset Research looking at expectations for global earnings in 2012. It is subtitled “Death by a thousand cuts; double digit downgrades for Eurozone and Japan” — so do not expect cheerleading.

The highlights:

• Recent earnings forecasts cut by 4.9% and 6.9% for 2011 and 2012, respectively.

• Severe downgrading of both 2011 and 2012 consensus forecasts, with Japan and the Eurozone seeing double-digit percentage cuts to

next year’s earnings;• US stands out with only minor cuts to 2012 forecasts.

Note that on an ex-financial basis, US 2012 forecasts have seen just a 2% cut, which SocGen describes as “hardly consistent with a recessionary or low growth outlook.”

So either we will miss a recession in the US, or analysts are too optimistic.

>

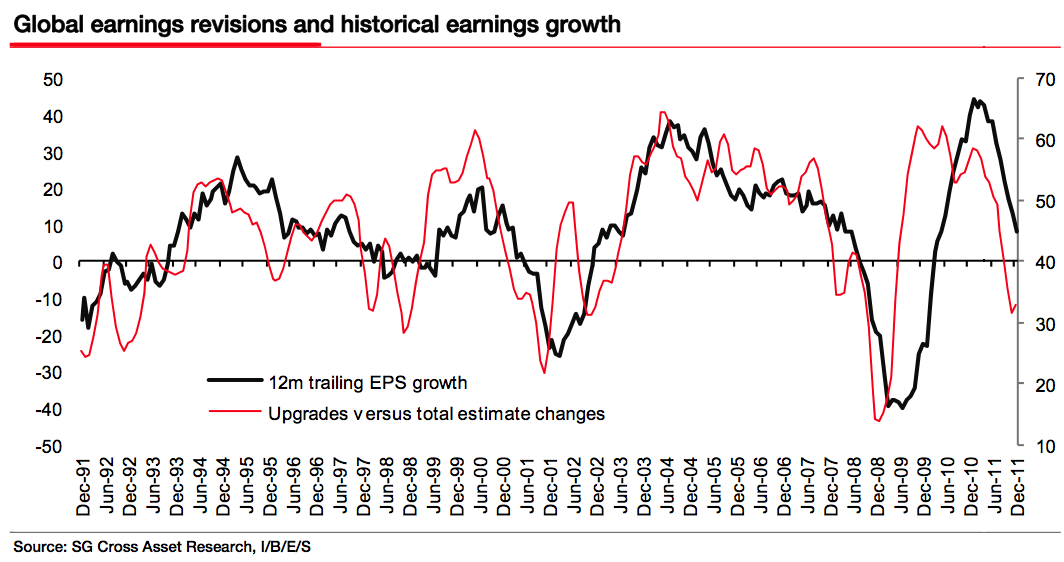

Global earnings revisions and historical earnings growth

click for ginormous chart

>

Source:

Global Earnings Estimates Analysis: Death by a thousand cuts; double digit downgrades for Eurozone and Japan (PDF)

Societe Generale, December 22, 2011

www.sgresearch.com

What's been said:

Discussions found on the web: