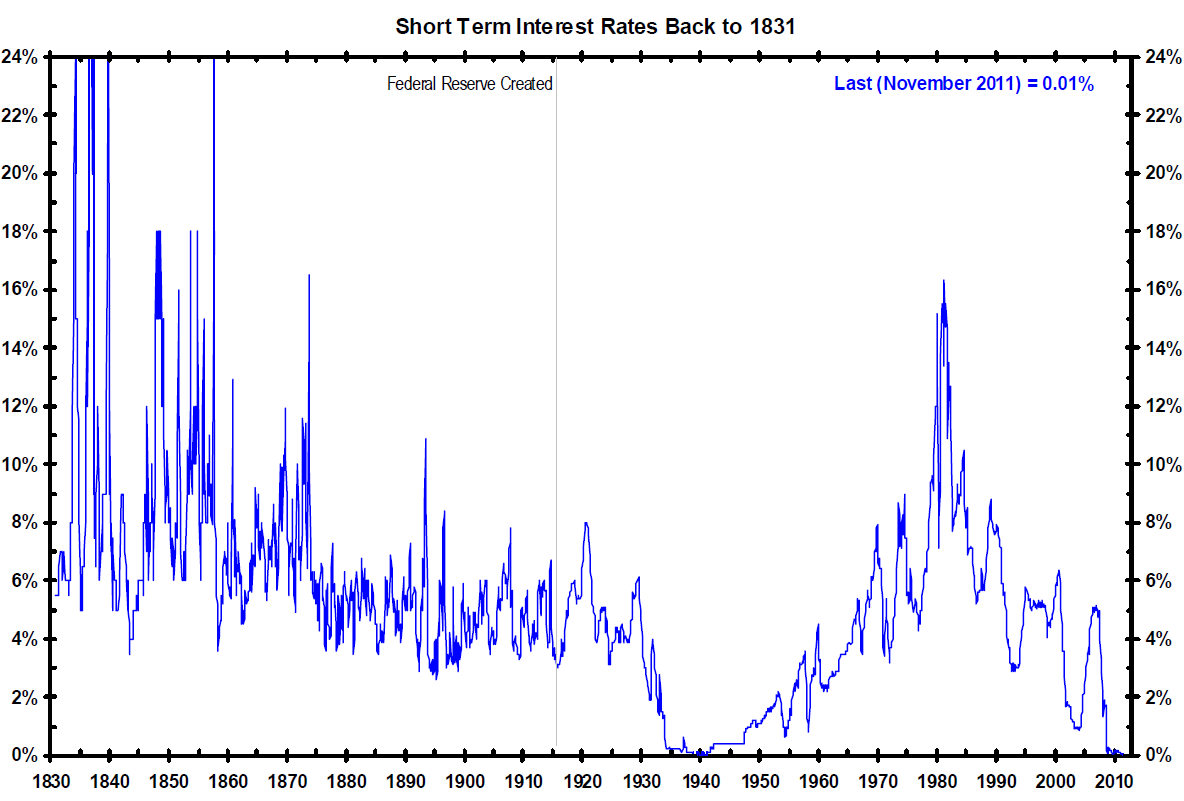

Click to enlarge chart

Source: Bianco Research LLC

>

Fascinating chart from Jim Bianco, looking at interest rates back nearly 2 centuries.

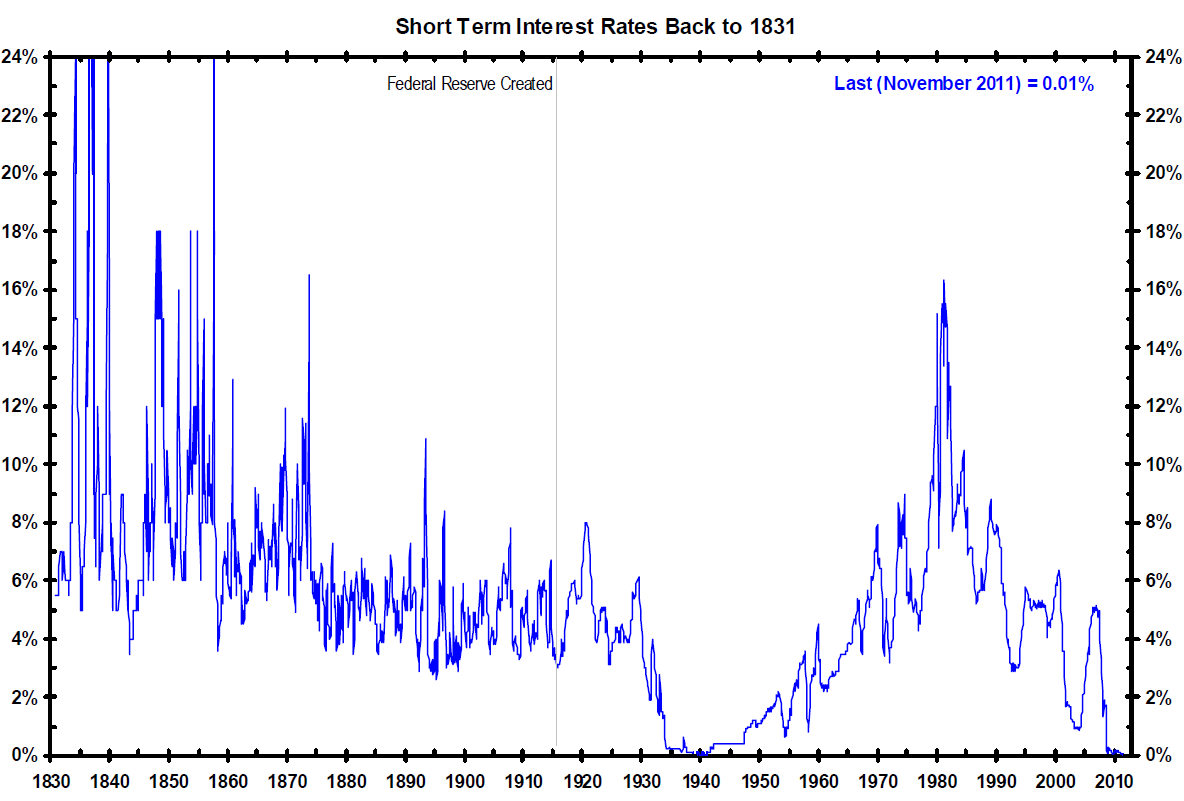

Click to enlarge chart

Source: Bianco Research LLC

>

Fascinating chart from Jim Bianco, looking at interest rates back nearly 2 centuries.

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: