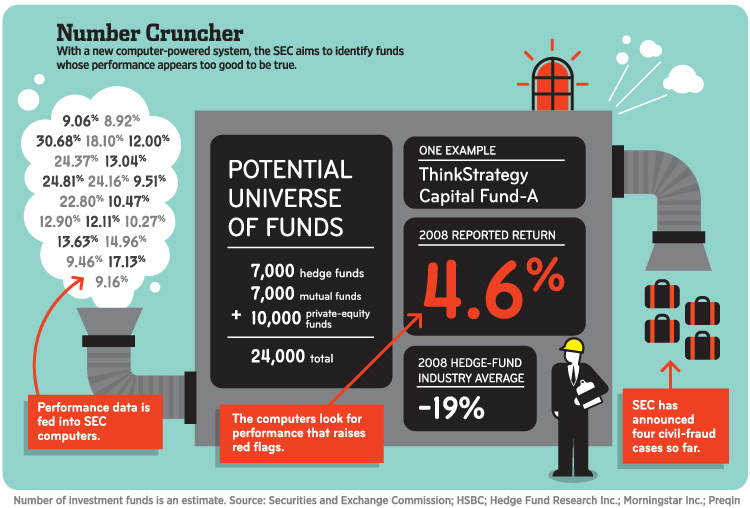

I was pleasantly surprised this morning to see a WSJ article that suggests the SEC is beginning to use the tools of Quantitative Research in its enforcement: SEC Ups Its Game to Identify Rogue Firms. This is a positive step for enforcing the laws governing markets.

Recall 3 years ago, we asked if the SEC did Quantitative Research?

“I would suggest to the incoming head of the SEC to put together a blue ribbon of math professors, quant scientists and algo specialists to develop a few basic programs that ferrets thru market, options, and performance data looking for aberrational data series, and leading to criminals and fraud artists.”

Then again two years ago, during the option backdating scandal, we noted the advantages of using quant tools for law enforcement:

“It also points out the need for the SEC to develop a Department of Quantitative Analysis filled with math geeks and computers, doing nothing but sifting through data looking for investor fraud. I’d bet they would get more convictions than the rest of the SEC combined. (If someone in the SEC would call me, I’ll help you set it up).”

Mathematics provides an ability to sift through mountains of data to find anomalous results — whether you are looking for Alpha or Felons, it matters not. I am pleased to see that the SEC is adopting useful, cost-effective techniques. The bottom line is that the prosecutors whoa re charged with enforcing the rules have not been using the most current tools of the trade.

If this process continues to change — prosecutors actually pursuing criminals — perhaps we might begin to see investor confidence return to markets. Yes, this is only a small step — real improvement remains a long way off. But the camel’s nose is now in the tent, with more enforcement tools to follow.

>

Previously:

Does the SEC Do Quantitative Research ? (December 13th, 2008)

Mathematical Proof: Companies Manage Earnings (February 13th, 2010)

SEC Budget vs Wall Street Spending (March 9th, 2011)

Source:

SEC Ups Its Game to Identify Rogue Firms

WSJ, DECEMBER 27, 2011

JEAN EAGLESHAM And STEVE EDER

http://online.wsj.com/article/SB10001424052970203686204577116752943871934.html

What's been said:

Discussions found on the web: