My morning reads:

• U.S. Economic Data is Surprising Forecasters (Bloomberg) but see Retail Sales in U.S. Climbed Less Than Forecast (Bloomberg)

• Which Country Defaults Next? (Japan) (Montley Fool)

• EU Banks Selling ‘Crown Jewels’ for Cash (Bloomberg) see also Pondering a Dire Day: Leaving the Euro (NYT)

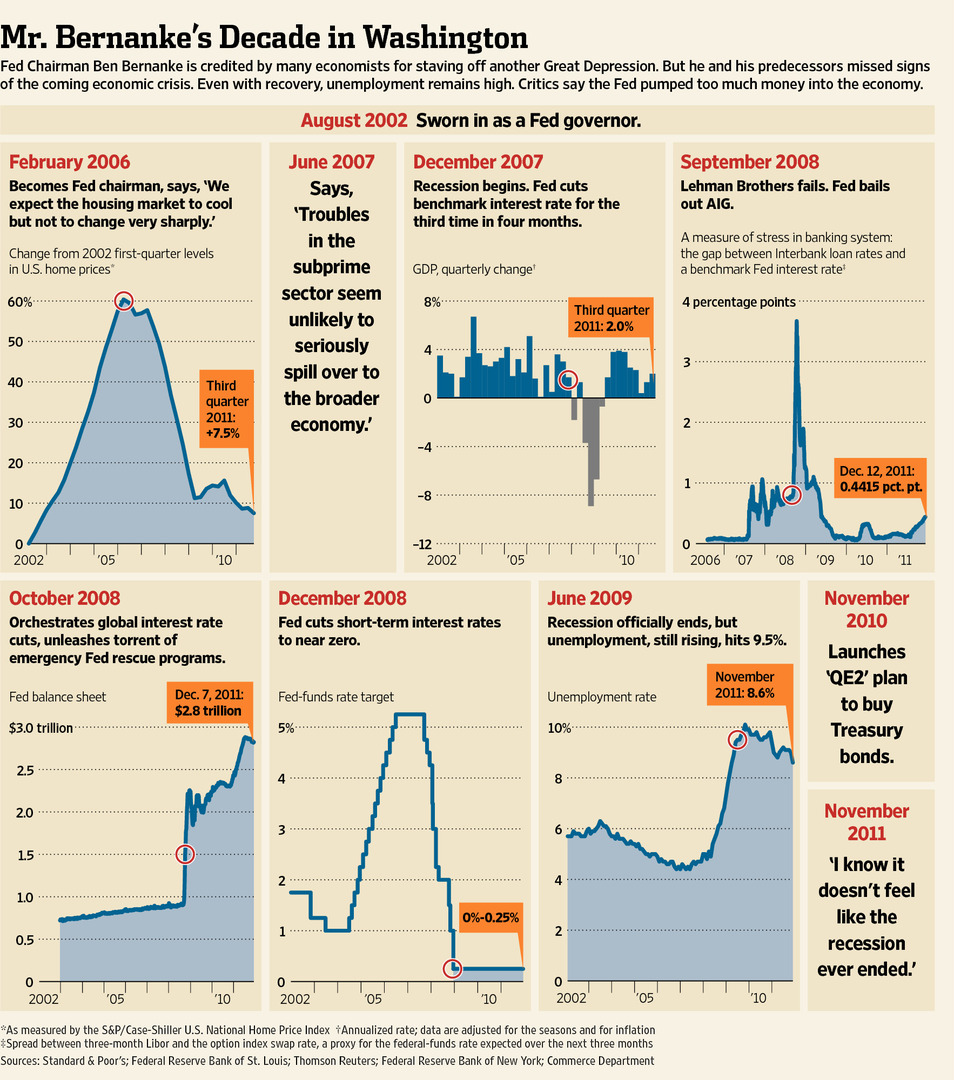

• Bernanke’s Legacy at Fed: Still a Lagging Indicator (WSJ)

• China’s housing bubble is losing air (LA Times)

• No One Says Who Took $586 Billion in Fed Swaps Done in Anonymity (Bloomberg) see also Are There Limits of Bigger Penalties in Fighting Financial Crime? (DealBook)

• Home Bargains Abound, But Willing Lenders Are Rare Breed (WSJ) see also Banks in Push for RoboSigning Pact (WSJ)

• Hedgies vs Obama (Reuters)

• From Garage To World’s Most Famous Company (Computer History)

• Unsubscribe (James Altucher)

What are you reading?

>

What's been said:

Discussions found on the web: