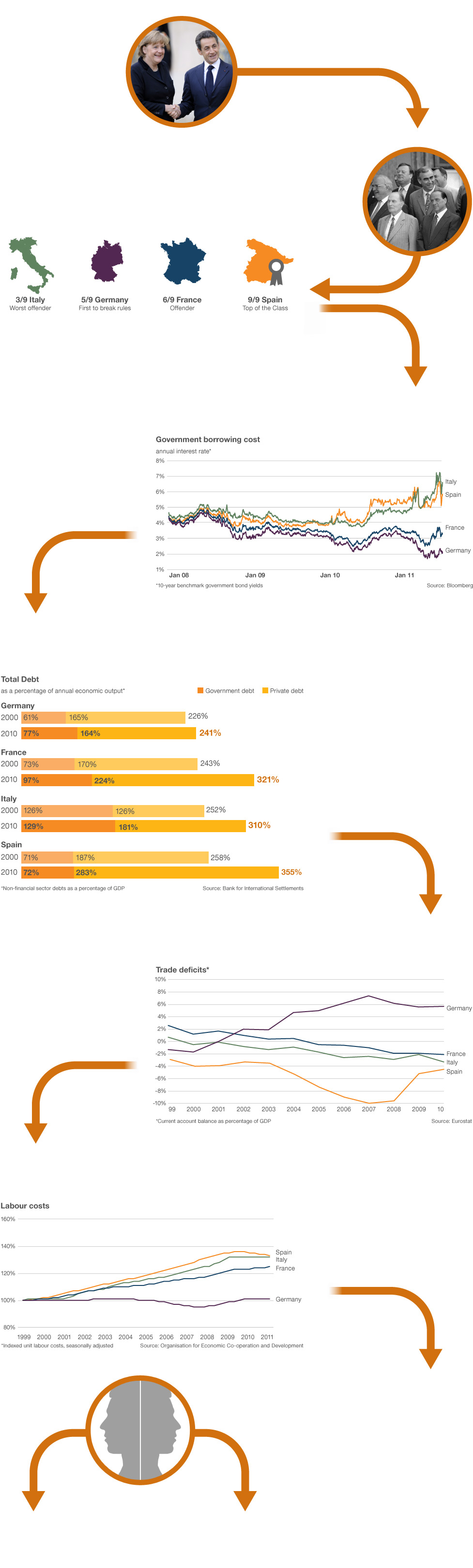

Great graphic of the EU crisis via the Beeb:

>

Click thru for enlarged version with full text:

Source:

What really caused the eurozone crisis?

BBC News, December 22, 2011

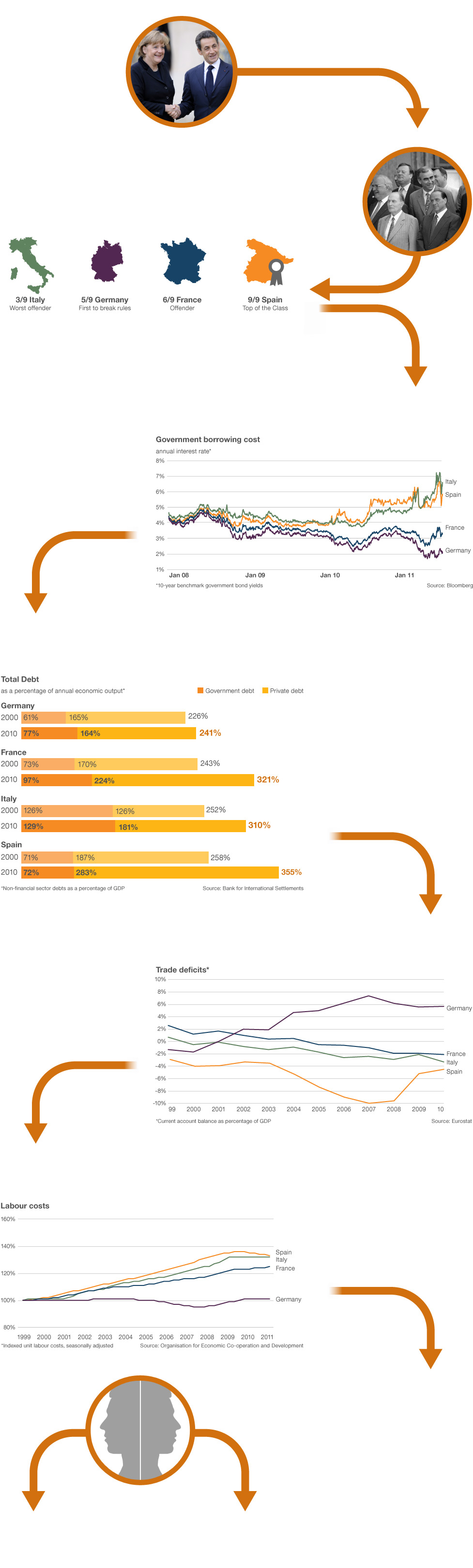

Great graphic of the EU crisis via the Beeb:

>

Click thru for enlarged version with full text:

Source:

What really caused the eurozone crisis?

BBC News, December 22, 2011

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: