Some reads to start off your day:

• Tech Giants’ Revenue Slows (WSJ) see also Google Cools Off, and Stock Drops (WSJ)

• Josh Brown: It’s an RIA World, Everyone Else Just Lives in it (WSJ)

• 5 Reasons QE3 Is Off The Table (Pragmatic Capitalism) but see China’s Manufacturing Contraction Boosts Case for Monetary Easing (Bloomberg)

• The Man Who Bought North Dakota: Wildcatter Harold Hamm is the biggest winner in biggest American oil find since Prudhoe Bay (BusinessWeek)

• New Normal on Wall Street: Smaller and Restrained (DealBook) see also Morgan Stanley Reducing Senior Pay 20% to 30% (Bloomberg)

• The Top 50 Technology Blogs to Watch in 2012 (The Entrepreneur Blog)

• Unearned, and Taxed Unequally (NYT) see also Why Taxes Aren’t as High as They Seem (NYT)

• Legal Twofer:

…..-Montana Supreme Court upholds election spending limits (LA Times)

…..-Tenth Amendment Zealots Block GOP’s Medical Malpractice Reform (TPM)

• How USPTO’s recklessness destroys business, innovation, and competition (BoingBoing)

• Concert Info: Who Owns My Ticket? (NYT)

What are you reading?

>

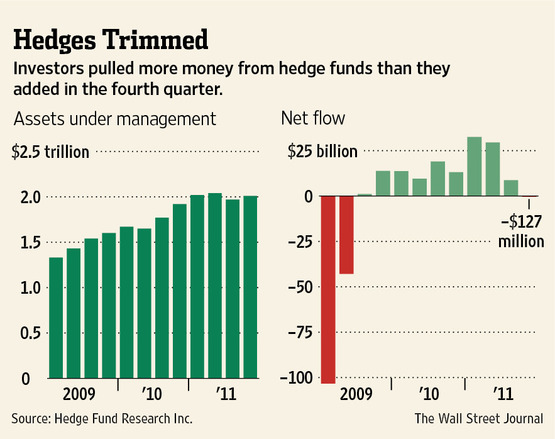

Investors Pull Cash From Hedge Funds

Source: WSJ

What's been said:

Discussions found on the web: