Early morning reads for the week:

• Revolving Door: From Top Futures Regulator to Top Futures Lobbyist (Rolling Stone) see also Could Huntsman and the Democrats Ally on Bank Reform? (Economix)

• What Would a European Tobin Tax Really Mean? (Spiegel.de)

• Stiglitz: The Perils of 2012 (Project Syndicate) see alos An Upside-Down Recovery Goes Back to Square One (Bloomberg)

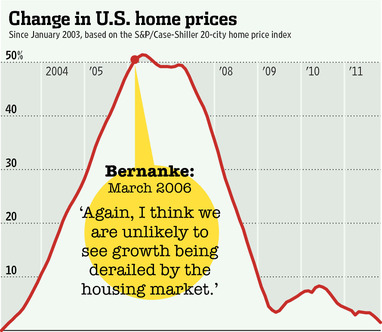

• Inside the Fed in 2006: A Coming Crisis, and Banter (NYT) Fed’s image tarnished by newly released documents (Washington Post)

• Borrowers turn lenders as banks tap firms for cash (Reuters)

• China: Get Ready for Turbulence (The Diplomat)

• Today’s WTF headline: Investors Say Supply Sider Arthur Laffer Backed a Ponzi (Court House News)

• The 160 Billion Dollar Bezzle (Psy-Fi Blog)

• Forecasting next week’s Apple education event (Mac World)

• Frustrations Mount As Conservatives Worry The Tea Party’s About To Blow It In 2012 (TPM)

What are you reading?

>

Source: WSJ

What's been said:

Discussions found on the web: