My train reading:

• U.S. retail sales rise scant 0.1% in December (Market Watch)

• Why Zombie Banks Hate to Write Off Bad Loans (Bloomberg) see also Banking Overhaul Reflects New, Leaner Era (WSJ)

• The view from SocGen Conference (Economist)

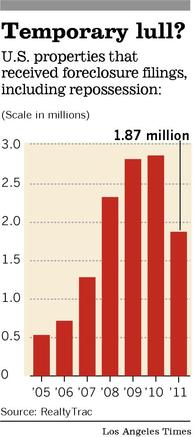

• Foreclosure filings hit four-year low in 2011 (Reuters) see also Foreclosures expected to rise, pushing home prices lower (LA Times)

• Why Merrill Lynch’s small-account penalty is a big mistake (Investment News)

• Here’s A Credit Card That Looks To Trap ID Thieves By Making Them Think They’re Clever (Consumerist)

• Study Confirms: News Networks Owned By SOPA Supporters… Are Ignoring SOPA/PIPA (TechDirt)

• Big Banks Struggle to Help Customers on Twitter (NYT)

• Conservative activists scrambling for a strategy to block Romney (Washington Post)

• Equal time: The Year of Microsoft (Slate)

What are you reading?

>

Source: LA Times

What's been said:

Discussions found on the web: