My afternoon train reading:

• The end of mutual funds is coming (Fortune)

• On Hoover’s Attempts to Rescue the Banks (Bloomberg)

• Obama to Use Pension Funds of Ordinary Americans to Pay for Bank Mortgage “Settlement” (Naked Capitalism) see also Investors eagerly eye U.S. foreclosure rental plan (Market Watch)

• Look to history for profitable stockpicking (FT.com)

• Private Inequity (New Yorker) see also Buffett Blames Congress for Romney’s 15% Rate (Bloomberg)

• On Economists and Psychopaths (Tim Iacono)

• The GOP’s suicide march (Washington Post) see also How conservatives lie about government (Salon)

• Let the Robot Drive: The Autonomous Car of the Future Is Here (Wired)

• Evolution Is Still Happening: Beneficial Mutations in Humans (Big Think)

• More US Consumers Choosing Smartphones as Apple Closes the Gap on Android (Nielson Wire)

What are you reading?

>

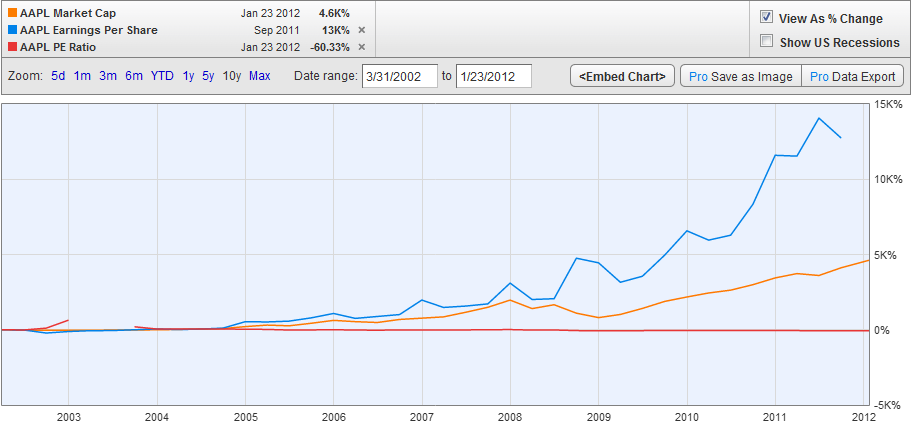

How Cheap is Apple?

Source Ivan Hoff Capital

What's been said:

Discussions found on the web: