“What does that mean– your ‘PM Train reading’ ?” demanded a nonspecific reader in a specifically hostile voice. It is quite literal: I take a train home; these are the items on my Instapaper (really) I have not gotten to read yet, but will on the way home:

• Mihm: Lessons for Europe From America’s First Great Depression: (Bloomberg)

• U.S. Tax Haul Trails Profit Surge (WSJ)

• Bill Gross: Towards the Paranormal (Pimco)

• Greek, Italian cash heads for hills, or under pool (Reuters) see also World’s Biggest Economies Face $7.6 Trillion Bond Tab as Rally Seen Fading (Bloomberg)

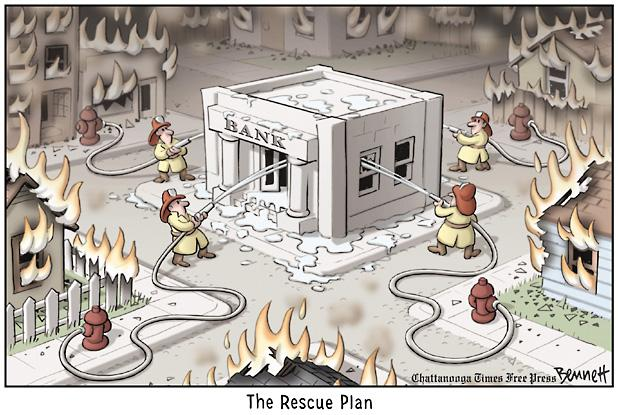

• Dimon Says JPMorgan Is Expanding Amid ‘Hostility’ Toward Banks (Bloomberg) Hostile? Fuck you!

• Dylan Goes Eclectic: As ‘An Advocate Who Hosts a Show,’ Can MSNBC’s Ratigan Broadcast Nuance to the Masses? (Observer) see also How Many Stephen Colberts Are There? (NYT)

• Why Best Buy is Going out of Business…Gradually (Forbes)

• Domo Arigato, Mr. Roboto (BoingBoing)

• Huntsman: No One Cares About Iowa (Fox News) see also Just Who Votes In The Iowa Republican Caucuses? (TPM)

• King of the Cosmos: Profile of Neil deGrasse Tyson (Carl Zimmer)

What are you reading?

>

Dimon: Why ARE people hostile to Banks? Its a conundrum!

What's been said:

Discussions found on the web: