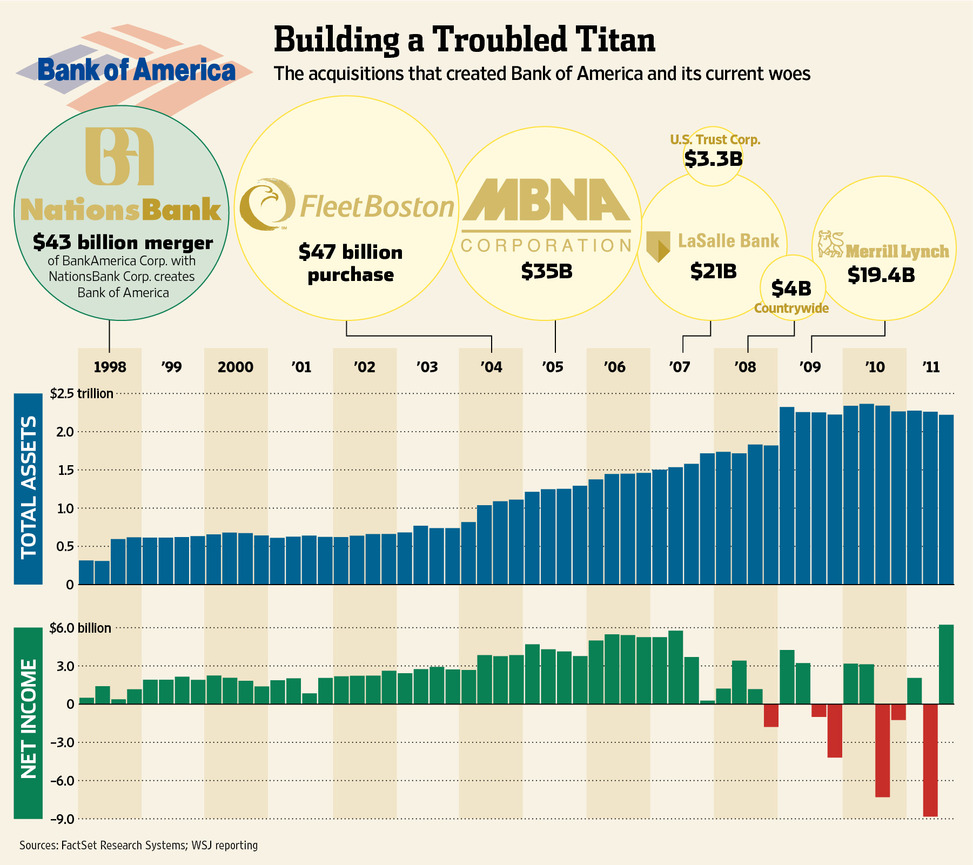

Great graphic in WSJ about the history of Bank of America:

>

click for larger graphic

>

I have no position in any money center banks — as long as their books are opaque (thanks to FASB 157), they violate the “know what you own” rule, making it difficult to place them into long term asset management accounts.

>

Source:

Bank of America Ponders Retreat

By DAN FITZPATRICK And JOANN S. LUBLIN

WSJ, January 13, 2012

http://online.wsj.com/article/SB10001424052970204409004577156881098606546.html

What's been said:

Discussions found on the web: