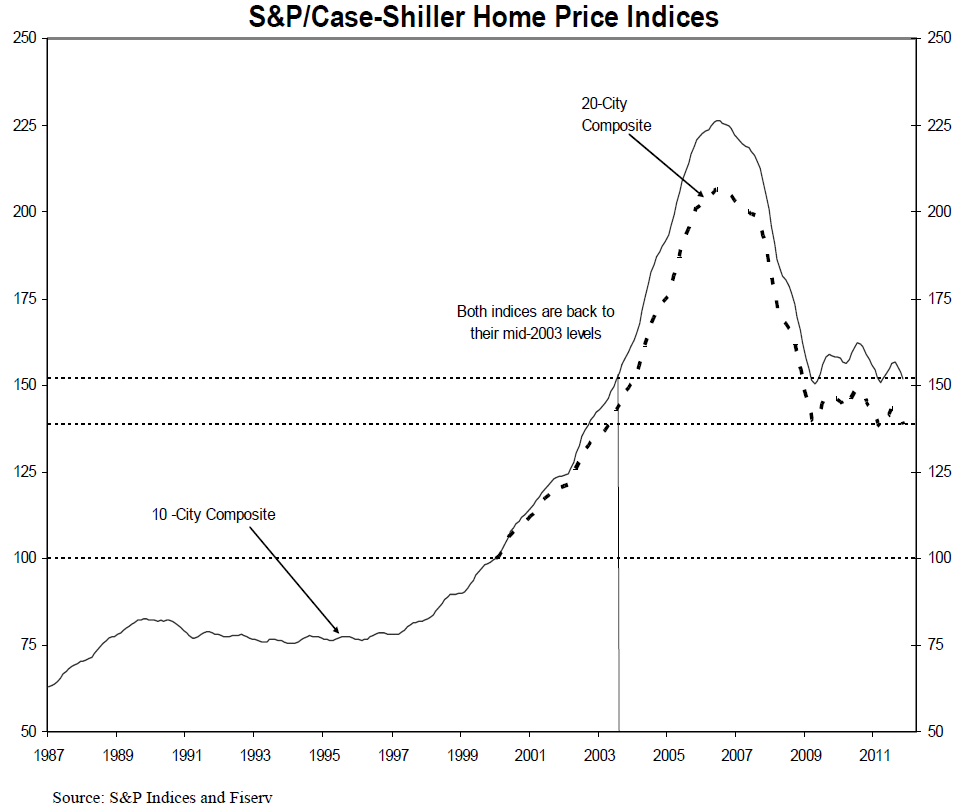

Through November 2011, the S&P/Case-Shiller1 Home Price Indices declined 1.3`% for both the 10- and 20-City Composites in November over October. For a second consecutive month, 19 of the 20 cities covered by the indices also saw home prices decrease.

For year over year data, the 10- and 20-City Composites posted losses of -3.6% and -3.7% versus November 2010. These are worse than the -3.2% and -3.4% respective rates reported for October.

Click to enlarge:

More charts after the jump

Source:

Home Prices Continued to Decline in November 2011

S&P/Case-Shiller Home Price Indices

New York, January 31, 2012

What's been said:

Discussions found on the web: