>

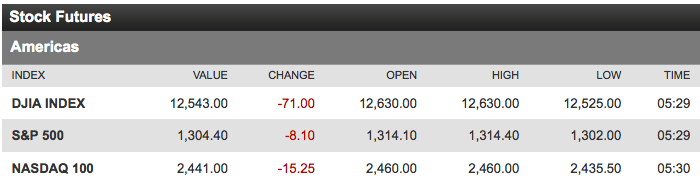

After a blistering open to the year — markets gained ~5% in the first 3 weeks — this past week was kinda flat — S&P added one point (not % — but a point) while the Dow lost 1/2%. Nasdaq, dragged upwards by Apple might Quarter, gained 1%.

The key question here is whether this is a pause that refreshes, a temporary break in the upwards action to consolidate recent gains, or whether the long awaited topping out has occurred. Lots of folks seem to be voting massive double top — from the 87 year old Joe Granville to the younger traders, there seems to be a groundswell of people thinking the market rally is finished.

Earnings so far this Q have disappointed. The January rally was merely an excess cash deployment, in their opinions, and is destined to fail.

On the other side are those people who believe the economic data is slowly improving, and its foolish to fight the Fed. Doug Kass believes this to be a consolidation.

Markets have been ignoring bad news out of Europe, not been disturbed by the raucous US elections, and mostly shaking off earnings news — is it denial, an eventual eureka moment or priced in? I suspect its none of the above — rather, the trader anticipation of a moon blast on the next QE announcement. Earnings? Fundamentals? PaShaw — its all about the power of the Fed’s mighty printing press. Indeed, in the post 2007-09 snapback rally — spitting distance from up 100% off of the SPX lows made March 2009 at 666 — its been a money loser to fight the Fed.

As to whether (or when) we top out, I have no opinion as of yet. I prefer to see more evidence that the rally is over before changing portfolio weightings. Otherwise, we are merely guessing.

More on this to come . . .

What's been said:

Discussions found on the web: