>

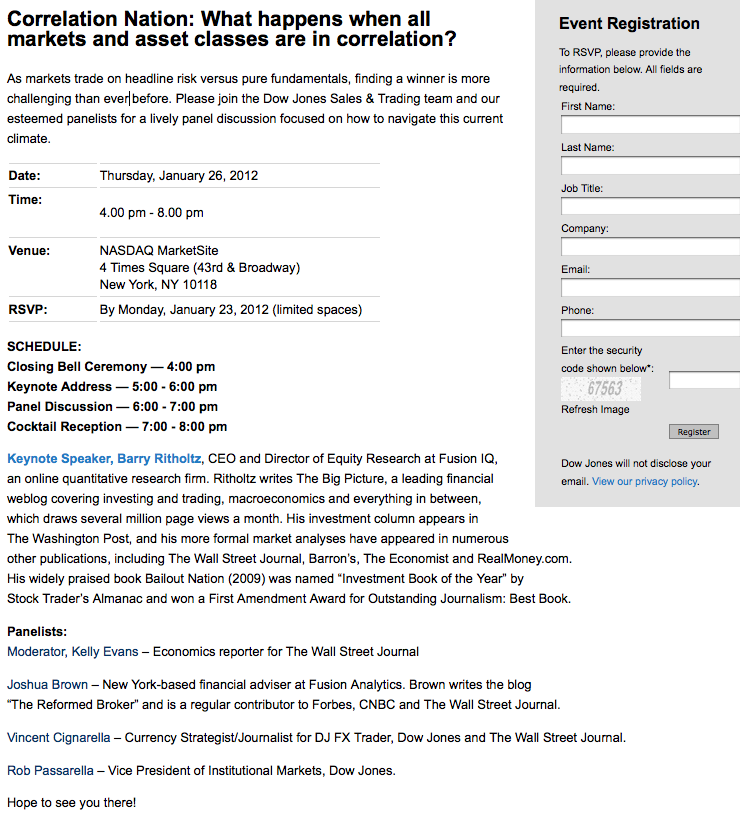

I am the keynote speaker today at the Dow Jones event: Correlation Nation: What happens when all markets and asset classes are in correlation?

As markets trade on headline risk versus pure fundamentals, finding a winner is more challenging than ever before. Kelly Evans hosts a panel discussion afterwards, with a reception to follow.

NOTE: You need to register for the event to attend.

>

To register, sign up here:

What's been said:

Discussions found on the web: