“A lot of the euphoria around the holiday shopping season was misplaced. The weakness in December implies that the handoff into the first quarter was weak. The savings rate is going higher and that’s going to be a headwind for consumer spending.”

-Neil Dutta, Bank of America economist, who was one of the few who correctly forecast sales data (Bloomberg).

>

For the past few months, I have been debating a few folks about my concerns 0ver Retail Sales. Based on the early data, anecdotal evidence of aggressive discounting, and the ongoing delveraging of US consumers, it looked like expectations were too high.

The actual sales failed to live up to the hype.

My initial pushback was due to the widely touted shopper survey from the National Federation of Retailers, whose annual idiocy manages to fool journalists and mislead the public each year.

But the bigger issue is the broader environment — I need not remind readers that this is not a robust cyclical recovery, but rather, a limping, post-credit crisis healing process. Expectations of a riproaring public shopping spree were simply wishful thinking. And now, the data officially confirms this.

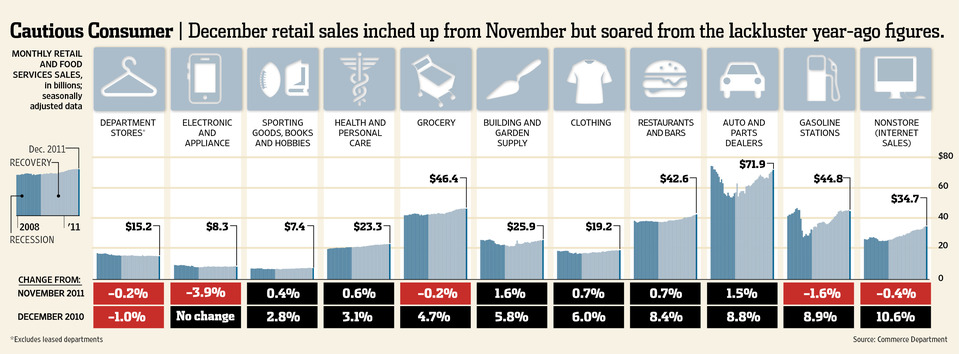

For the month of December, sales rose a pitiful 0.1%. Back out autos, and they fell 0.2%. This is the third consecutive month of decelerating growth, according to data from the Commerce Department. Food, gasoline and clothing all suffered from rising input costs — the gains you see in those sectors are primarily inflation. Even internet sales, a secular shift in spending habits, rose only 10% in December. They had been previously rising at a 15% rate.

The one true bright spot was Autos — following the freeze during the crisis, we now have a much older average aged fleet of US autos, and they are overdue for replacements.

What is going to be even more disappointing are margins and profits. To achieve the even mediocre sales data, retailers slashed prices, cut into margins, and offered steep discounts to lure consumers. They will see this reflected in their earnings. Aside from a few specialty sellers — think Apple and Lulu Lemon — we will see quite a few disappointments in the sector when the Retail Sales companies report their Q4 earnings next week. Watch for changes in guidance for the first half of 2012.

Those of you who may have downplayed the potential for a recession to start over the next 12-18 months way want to revisit your views on this. It is far from the low possibility many economists have it pegged at.

>

click for larger graphic

graphic courtesy of WSJ

>

Previously:

No, Black Friday Sales Were Not Up 16% — not even 6% (November 28th, 2011)

Beware the retail hype (December 10th, 2011)

Source:

Sluggish Sales Stir Concerns About Growth

JOSH MITCHELL And DANA MATTIOLI

WSJ, January 12, 2012

http://online.wsj.com/article/SB10001424052970204409004577156480196830386.html

What's been said:

Discussions found on the web: