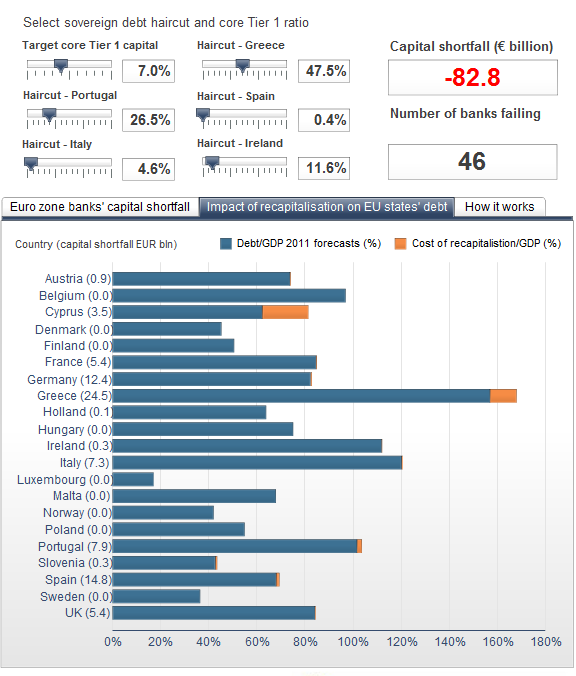

Here’s another fun quiz, this one from Reuters Breakingviews:

Wanna know how much Capital that needs to be raised by Eurozone banks? How much of a haircut Greek bondholders are going to take?

Play with the sliders on this to find out:

>

Click for interactive chart:

Source: Reuters

What's been said:

Discussions found on the web: