My afternoon train reading:

• What is the value-added of managers – and the all too common mistake of confusing charisma with management skills: Football’s best managers (FT.com) see also Weaning Off ‘Alternative’ Investments (WSJ)

• The Baltic Dry Meltdown Continues (WSJ)

• Are Companies More Powerful Than Countries? (Time)

• U.S. Stocks in Longest Valuation Slump Since Nixon (Bloomberg)

• ROBERT SHILLER: A Housing Bottom? What Are They Thinking? (Business Insider)

• The Yin and the Yang of Corporate Innovation (NYT)

• Wealth can be a political burden (Washington Post) see also How Romney’s Tax Rate Stacks Up To Recent Presidential Candidates’ (TPM)

• NYT Goes Deeper on Chinese Apple Factory Working Conditions: Human Costs Are Built Into an iPad (NYT)

• Fighting Bullshit (MOJO: Parts 1 and Part 2)

• Hilarious Tumblr blog: Newt Gingrich Judges You (Newt Gingrich Judges You)

What are you reading?

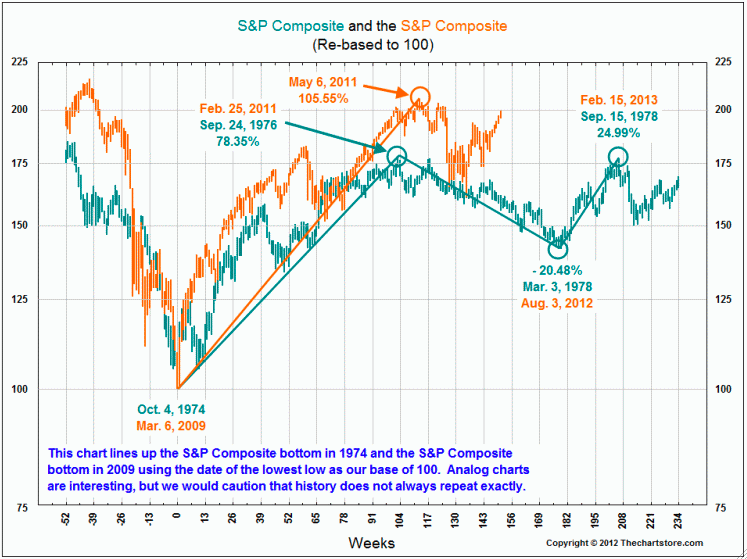

2009 low vs 1974

What's been said:

Discussions found on the web: