>

Last month, I presented to the National Association of State Treasurers. The room had all 50 State Treasurers, lots of Deputy and Asst Treasurers, and staff. I was realistic about how credit crises unwind over long periods of time.

The prior panel had the major ratings agency reps, and they had discussed Pension Return Assumptions. Given their utter incompetency, it was no surprise the Ratings firms were okay with expected blended returns of 8%.

An audience member asked a question to me about this, and I laughed. I told the Treasurers that the consultants who tell them they should have expected 8% blended returns for the past 5-10 years were dead wrong, and the ones who told them they could expect 8% blended returns for the next 5-10 years were probably high. My joke was to get to 8% required bad math — blended expected returns of 8% requires taking 5% gains in equities and adding 3% gains in bonds (5+3=8). How often do you get to make a wonky accounting joke to a room full of treasurers?

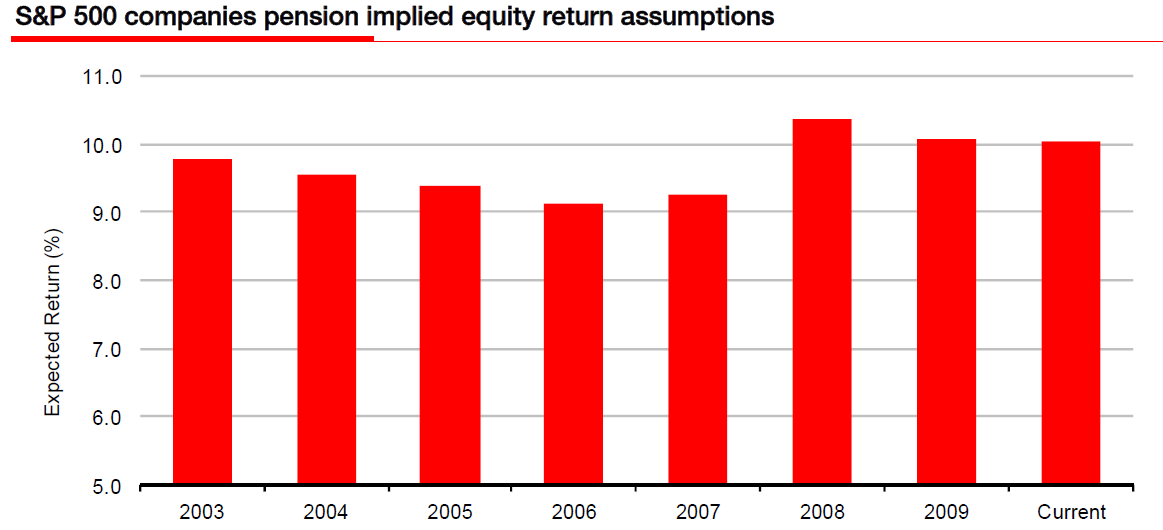

But, as it turns out, its even worse on the Corporate side: S&P 500 companies pension funds. They currently assume future equity returns of above 10%, according to their own financial statements. As I made clear to the State Treasures, that is an absurd expectation.

Andrew Lapthorne of Société Générale’s Global Quantitative Research group points out how absurd this is:

“No-one believes these ridiculous – earnings flattering – pension fund return assumptions, not even US CFOs themselves.

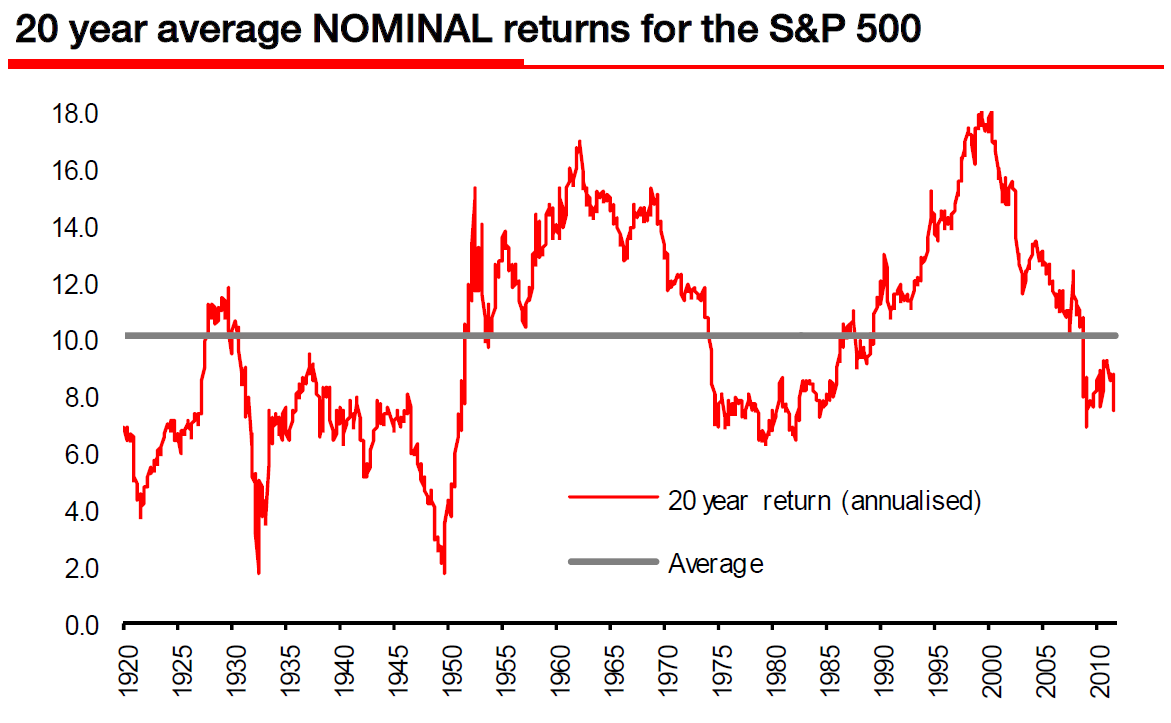

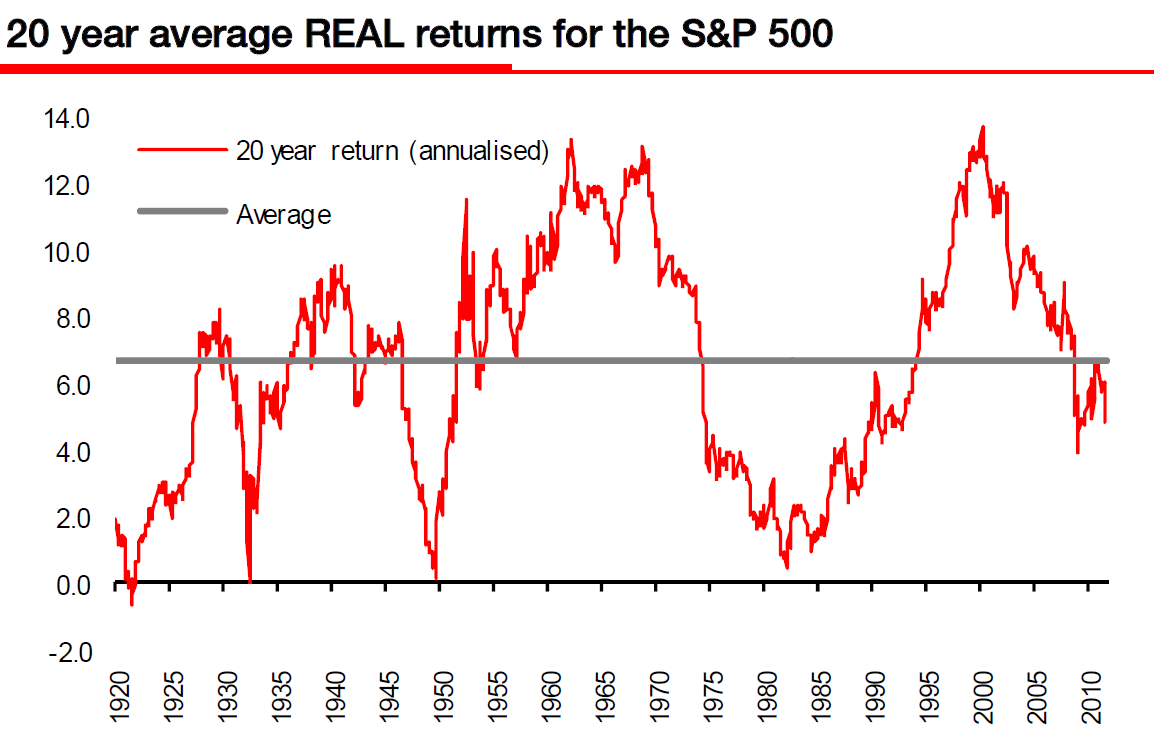

A couple of months ago we highlighted how the implied yield on a traditional balanced portfolio comprising a mix of bonds, equity and cash had fallen to below 3% less than half of what it was 20 years ago. We suggested (and still do) that with such low yields, generations of investors are facing a potential future income crisis going forward.

Low yields (and as a consequence low returns and annuity rates) is not a new problem. Although particularly compressed now, yields have been depressed for the past decade. However, the consequences being felt today are becoming more acute. Pension entitlements are falling, some companies (AMR, for example) are entering Chapter 11 to help avoid paying them, and endowment mortgages, plus a whole raft of other investment products, are coming up short.

The reality of low yields is the need to save more and spend less. But rather than accept the notion of lower returns and adjust behaviour accordingly, the path of least resistance appears to be total denial…”

We have ultra low yields after 3 years of ZIRP and a market that is precisely where it was 11 years ago. Valuation using forward earnings estimates are at best reasonable, and using trailing 10 year and/or CAPE are subject to potential reversals off of an earnings peak. US equity returns may quote possibly be in the single digits over the coming decade.

Is this the circumstances that lead to 10% plus blended returns for the next decade?

>

Click to enlarge:

>

Source: Quant Quickie, 5 January 2012

Societe Generale – Global Quantitative Research

What's been said:

Discussions found on the web: