>

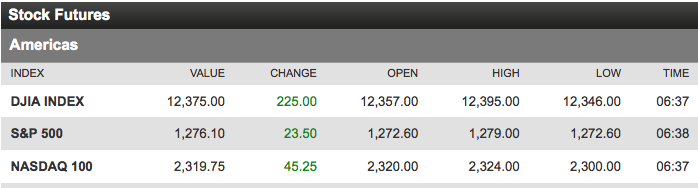

Welcome back to work! Futures are looking up by 2%, following rallies in Asia and Europe.

Lots of fund managers come into the new year carrying plenty of cash. They had unceremoniously dumped the losers they were too embarrassed to show on their books at the end of Q4. This sets up the January effect, especially amongst smaller cap names, that can snap back after the December sales.

But it also leaves these managers holding excess cash, which they often feel compelled to put to work right away, so as to not fall behind their benchmark (which carries no cash).

We like to see Institutional buying. In its purest form, it conveys conviction, implies ongoing purchases over longer periods of time. Generally speaking, it suggests that there is an ongoing flow of money into equities, typically based on expectations for improving earnings and supportive of higher prices.

Unfortunately, this New Year’s rally does not seem to have any of those features. The cash getting put to work can move markets, but it is ephemeral — not typically a lasting trend. I am happy to see markets go higher — I have a decent slug of equity holdings in my portfolios (>50%) — but I am more concerned about the damage of the next leg down than the gains of the present rally.

What would increase my enthusiasm stocks? As noted, I prefer conviction driven, not calendar focused moves. I want to see stronger, not lighter volume. And, I prefer to see the leading sectors of the economy lead the market — that means financials, technology, and consumer goods. As we noted Sunday, sentiment has gotten pretty negative. But its not at levels associated with long term rallies.

The bottom line is this: These rallies are for traders, not longer term investors. We remain mired in a long term secular bear market — and that means preserving capital and managing risk. Yes, you can be opportunistic, but that is a secondary, not primary objective.

Be smart, think out your goals, have a plan and trade safe in 2012

What's been said:

Discussions found on the web: