My early morning reads:

• Trouble for ‘Big Crony’ (Clarion Ledger)

• Why Narcissistic CEOs Kill Their Companies (Forbes)

• David Rosenberg Explains What (If Anything) The Bulls Are Seeing (Zero Hedge)

• Why TARP Losses Don’t Get Reported (Government Accountability Office)

• Big Banks Face Inquiry Over Home Insurance (NYT) see also Financial Frankness Is a Bad Dream for a Bank (Bloomberg)

• Study: Americans believe conflict between rich, poor is growing (Washington Post)

• A World Without China (HuffPost)

• Underwater Homeowners May Swim Freely (Pro Publica) see also Corruption in the Florida AG’s Office: Staff Helps Lender Processing Services (Naked Capitalism)

• Mister, I Don’t Sell to Fish (Interloper)

• Working In Word, Excel, PowerPoint On an iPad (All Things D)

What are you reading?

>

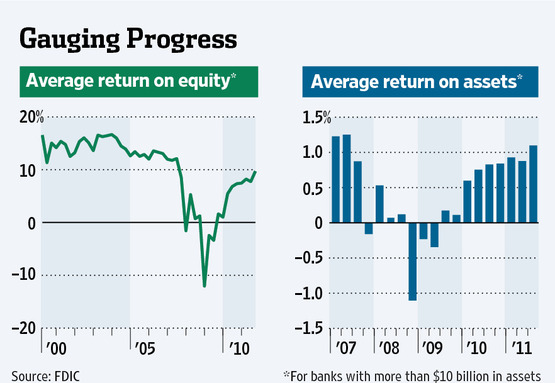

Banks Still Struggle to Find Happy Returns

Source: WSJ

What's been said:

Discussions found on the web: