My morning reads:

• The unprecedented behaviour of the central banks (FT.com)

• Europe’s $39 Trillion Pension Threat Grows as Economy Sputters (Bloomberg)

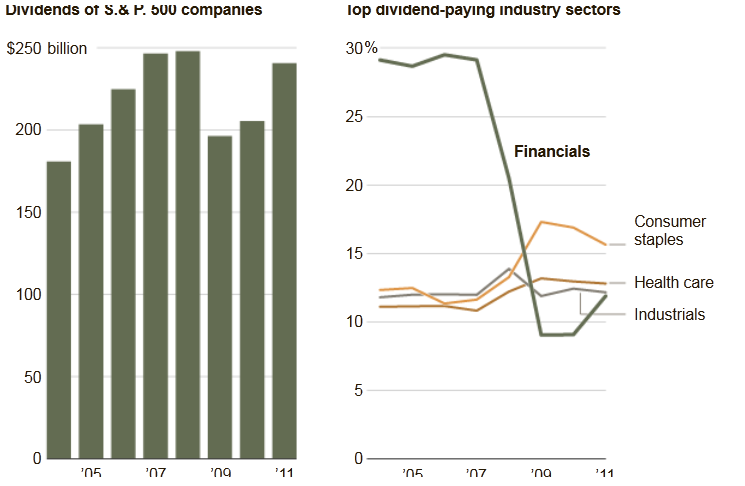

• Right Kind of Dividend Makes a Difference (WSJ) see also Dividends Rise in Sign of Recovery (NYT)

• Let’s talk about the market economy (John Kay)

• Blackstone Group says it “sucks” (Schwarzman, too!) (Domain Name Wire)

• In Greece, fears that austerity is killing the economy (Washington Post) see also Greek parents too poor to care for their children (BBC)

• Microsoft Says 4Q PC Shipments Likely Fell Short (Bloomberg) see also The Critics Rave … for Microsoft? (NYT)

• NYSE Deal Nears Collapse (WSJ)

• Romney Follows GOP Pattern of Losers Who Win (Bloomberg) see also Gingrich-Sponsored Attack Film Shows Romney as ‘Ruthless’ Rich (Bloomberg)

• Jacob Lew, Obama Nominee And Former Citigroup Executive, Doesn’t Believe Deregulation Led To Financial Crisis (HufPo)

What are you reading?

>

Dividends Rising

Source: NYT

What's been said:

Discussions found on the web: