Some longer reads to start your Sunday :

• Among the Wealthiest One Percent, Many Variations (NYT) see also The Bifurcated Society (Rick Bookstaber)

• Hiring Logjam Breaks as CEOs Plan Growth (Bloomberg)

• Yields Plunge on Big Rally (The Bond Buyer)

• Simon Johnson: Refusing To Take Yes For An Answer On Bank Reform (The Baseline Scenario)

• Mr. Davidson’s Planet: NPR/NYT Guru Adam Davidson’s Discredited Economic Principles (AlterNet)

• Bloomberg Suffers, Too, in Collapse of MF Global (DealBook)

• Steve Ballmer Reboots (Businessweek) see also Why Google is ditching search (CNet)

• CES: Fever Dream of a Guilt-Ridden Gadget Reporter (Gizmodo)

• Star Trek-style ‘tricorder’ invention offered $10m prize (BBC)

• The True Story Of How A Ferrari Ended Up Buried In Someone’s Yard (Jalopnik)

• Open knowledge saves lives. Oppose H.R. 3699! (E Patients) see also Clumsy medics in Mexico City drop donor heart – video (Guardian)

What are you reading?

>

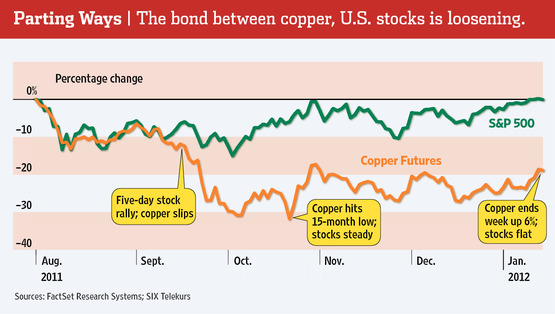

Dr. Copper Gets a New Specialty

Source: WSJ

What's been said:

Discussions found on the web: