I have been meaning to write this idea up for some time — I have discussed it in the media previously, but never really drafted a full article about it — Now I see Adam Davidson of Planet Money has beat me to it with his take.

My approach is rather different. What Wall Street does well is allocate capital to deserving new businesses and technologies (and quite a few undeserving ones as well). And if you ignore the hype, you can save money for retirement — but it is a challenge to learn how to do so in the face of the Buy & Hold mantra.

Not all of Wall Street is a disaster. Capital markets are a major contributor to both the economy and society.

When they buy Congress, become reckless, and use too much leverage that we have real troubles. Then comes the taxpayer funded bailouts, and it heads south from there.

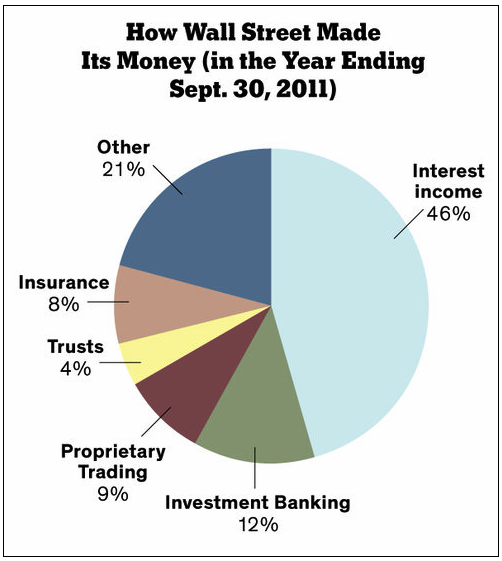

Anyway, Adam discusses where Wall Street’s bread is buttered, and what they do that is positive in this coming Sunday’s NYT magazine. I don’t agree with his take on all of it, but what caught my eye was this chart:

>

>

Source:

What Does Wall Street Do for You?

ADAM DAVIDSON

NYT, January 11, 2012 http://www.nytimes.com/2012/01/15/magazine/what-does-wall-street-do-for-you.html

What's been said:

Discussions found on the web: