QOTD: Bastiat on Plunder

Fantastic quote from Bastiat: “When plunder becomes a way of life for a group of men living in society, they create for themselves,...

My afternoon train reading: • Trade of the Year? (The Reformed Broker) • Top 10 Hedge Funds By Net Gains Since Inception (Market...

My afternoon train reading: • Trade of the Year? (The Reformed Broker) • Top 10 Hedge Funds By Net Gains Since Inception (Market...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Click to enlarge: The Financial Times – Obama pressed to open emergency oil stocks The Obama administration is coming under growing...

Click to enlarge: The Financial Times – Obama pressed to open emergency oil stocks The Obama administration is coming under growing...

You can stream Bloomberg Radio live by clicking below: > I am off to Bloomberg TV to discuss my Washington Post column on Robo-signing...

You can stream Bloomberg Radio live by clicking below: > I am off to Bloomberg TV to discuss my Washington Post column on Robo-signing...

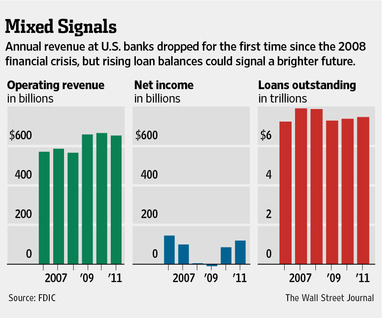

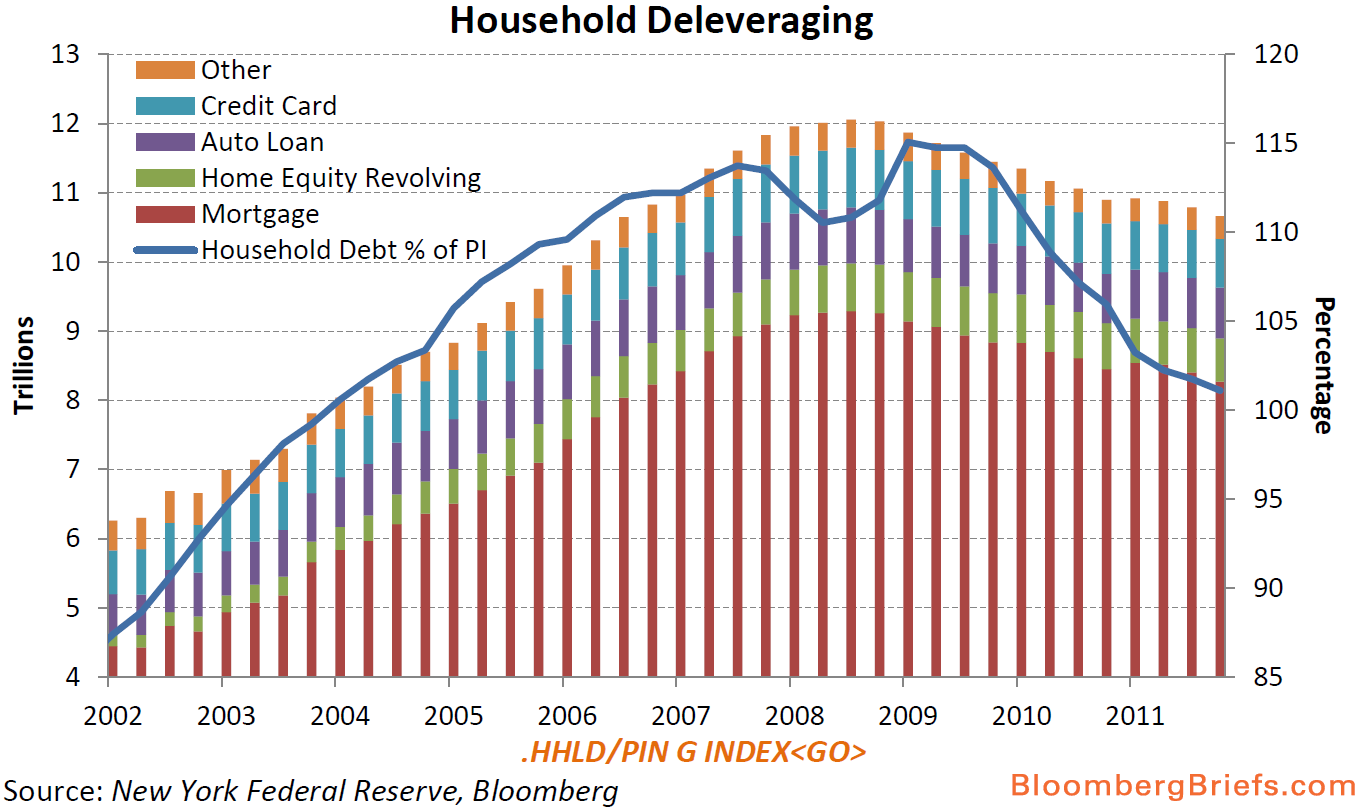

Click to enlarge: Source: Bloomberg BRIEFs Economic Newspaper February 28, 2012 > Why has the recovery been so weak? The short answer...

Click to enlarge: Source: Bloomberg BRIEFs Economic Newspaper February 28, 2012 > Why has the recovery been so weak? The short answer...

Get subscriber-only insights and news delivered by Barry every two weeks.