Here’s a look at what I was reading before I started taking apart the BLS NFP data (more on that later):

• Senate Votes To Ban Its Members From Insider Trading… Kind Of (TPM)

• The Hidden Burden of Ultra-Low Interest Rates (Businessweek)

• S.E.C. Is Avoiding Tough Sanctions for Large Banks (NYT)

• Will the great interest rate gamble pay off? (Telegraph) see also Negative Interest Rates—a Minus for Growth? (Barron’s)

• In a Focus on Gold, History Repeats Itself (NYT)

• Lax Oversight Blamed in Demise of MF Global (DealBook) see also Too little too late? CME Creates $100 Million Fund for Farmers and Ranchers (DealBook)

• With Tax Break, Corporate Rate Is Lowest in Decades (WSJ)

• Baltic Dry Index two-fer:

…..-Commodity Shipping Costs Slump to Lowest in Quarter Century on Vessel Glut (Bloomberg)

…..-The Death of a Leading Indicator? Baltic Dry Loses Luster (Fox Business)

• Anatomy Of A Come Back? Charting Obama’s Approval (TPM)

• Citizens United: Colbert v. the Court (Slate)

What are you reading?

>

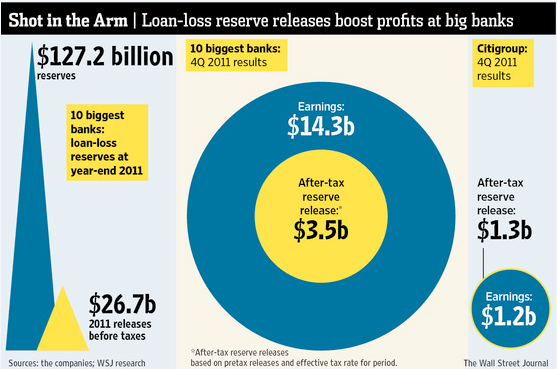

Banks Depleting Earnings Backstop

Source: WSJ

What's been said:

Discussions found on the web: