My morning reads:

• Sentiment warning: Wall St Week Ahead: Bulls will not be tamed by weak earnings (Reuters)

• Are We Already Planting the Seeds of the Next Financial Crisis? (Time)

• A fate worse than a hard landing for China (FT.com) see also China’s central-bank chief upbeat on euro crisis (Market Watch)

• Is QE working?, asks the Bank of England (FT.com)

• Occupy the SEC Weighs In on the Volcker Rule (Businessweek) see also Occupy’s amazing Volcker Rule letter (Reuters)

• Inside baseball: LPL on the ‘Greatest Bull Market in History of Advice’ Under Way (Financial Planning)

• Rise of the Facebook-Killers (Village Voice)

• A look at relative P/Es: Is Apple (AAPL) a $17,000 Stock? (Bespoke)

• Obama Housing Plans vs. Reality (ProPublica)

• Digital Advertising and News (Journalism) see also Where Financial Firms Spend Ad Dollars Online (Reformed Broker)

What are you reading?

>

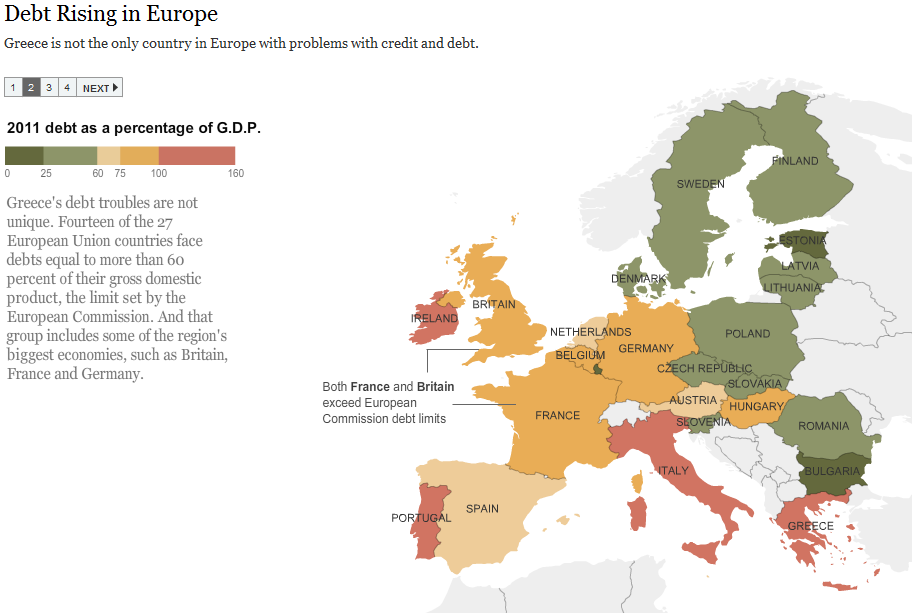

Debt Rising in Europe

Source: NYT

What's been said:

Discussions found on the web: