Here are my morning reads:

• Economy in U.S. Grew at 3% Pace in 4th (Bloomberg) see also U.S. Growth Revised Up (WSJ)

• Doubtful Signs of a Criminal Case Against MF Global (DealBook)

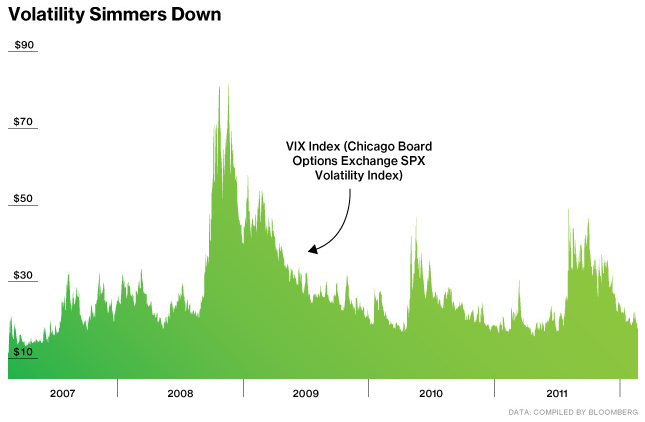

• Risk On: Was 2008 Just a Bad Dream? (Businessweek) see also Why it took the Dow so long to eclipse 13K (MarketWatch)

• Should the United States join OPEC? (NY Times)

• Wall Street was never on your side (Abnormal Returns)

• As Bank Profits Plunge, Wall Street Bonuses Fall Modestly (DealBook) see also Wall Street Bonus Pool Shrinks 14% (WSJ)

• Insider Probe Targets a Top Goldman Manager (WSJ)

• Grading the Obama Economic Record (Economix)

• Ron Paul, Party Crasher (New Yorker)

• A Silicon Valley Tale of Humiliation and Revenge (Inc.)

What are you reading?

>

Source: Businessweek

What's been said:

Discussions found on the web: