My early morning reads:

• Big Long Is New ‘Big Short’ as Bass Joins Subprime Bet (Bloomberg)

• The Letter: Hedgies’ tool of choice (Alphaville) see also Hedge fund managers looked to tech in 4th quarter (Reuters)

• The low number of new highs: Fewer stocks hit 52-week highs (Marketwatch)

• The Secret Meeting That Launched the Federal Reserve (Echos)

• Sentiment Survey (American Association of Individual Investor)

• Paul Volcker vs. the Bank of Canada (Economix) see also JPMorgan, HSBC Among Firms Accused by Informant Bank in Canada Libor Case (Bloomberg)

• Number crunchers are dead set on figuring out how long you will live. For those saving for retirement, it’s the $27 trillion question. (Smart Money)

• The Mystery of the Millionaire Metaphysician (Slate) see also Does the rebound effect matter for policy? (Grist)

• The Prophets of Linsanity (Businessweek)

• Your address book is mine: Many iPhone apps take your data (Ventrue Beat) see also Mobile Apps Take Data Without Permission (Bits)

What are you reading?

>

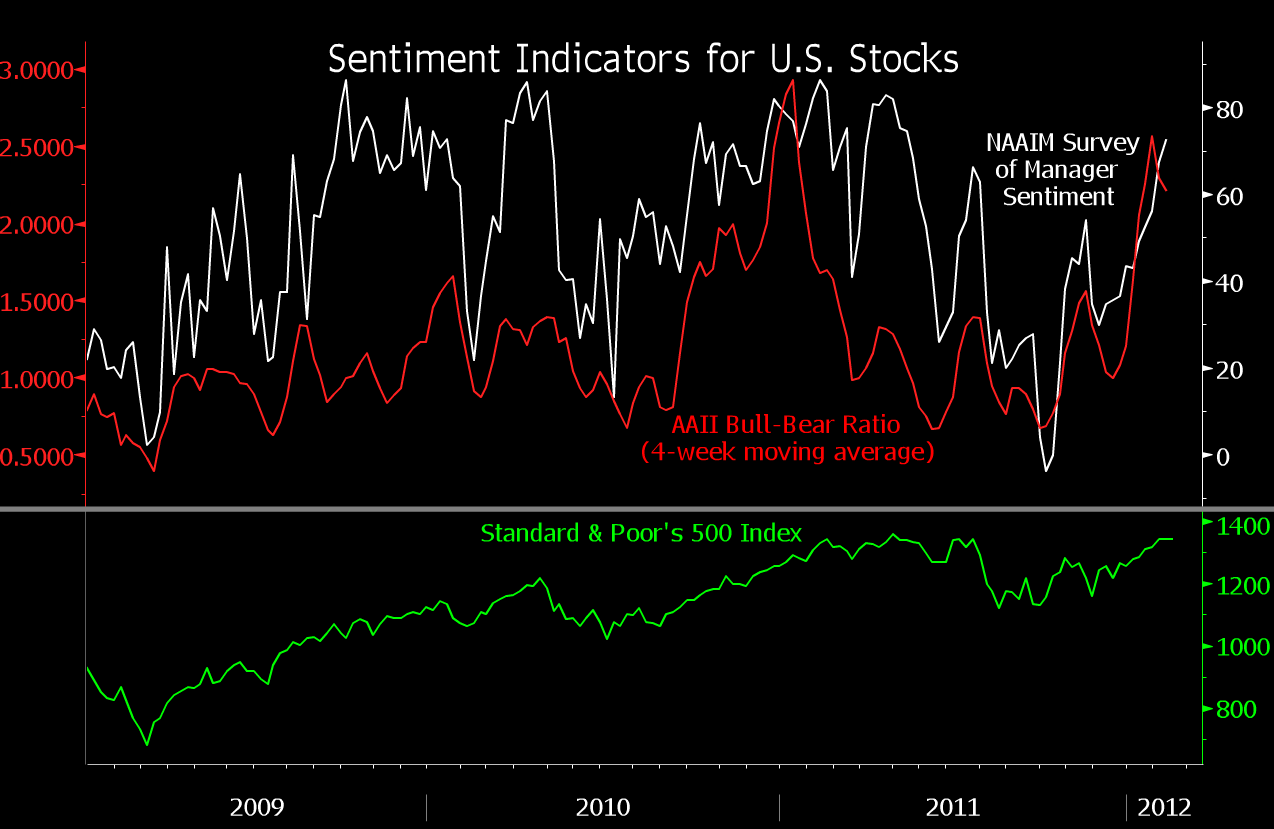

Too Much Optimism Points to U.S. Stock Losses

Source: Bianco/Bloomberg

What's been said:

Discussions found on the web: