My afternoon train reading

• How Companies Learn Your Secrets (NYT Magazine)

• MBIA tells judge of newly uncovered Countrywide fraud database (Reuters)

• When Models Trump Common Sense (Tim Iacono)

• Citigroup Whistle-Blower Says Bank’s ‘Brute Force’ Hid Bad Loans From U.S. (Bloomberg)

• 5 Lessons From the Rise of the BRICs (The Atlantic)

• Is Any CEO Worth $189,000 Per Hour? (Businessweek) see also The Top 1% Must Stop Insisting They’re Not Rich Right This Instant (Gawker)

• Forget Buffett — it’s time for the Dimon Rule (Washington Post)

• The Japanese liquidity trap, revisited (Alphaville)

• Venture Capital: The new money men (Crains New York)

• The Delivery Guy Who Saw Jeremy Lin Coming (WSJ) see also Basketball-Crazy China Ponders Meaning of Jeremy Lin’s Race (Bloomberg)

What are you reading?

>

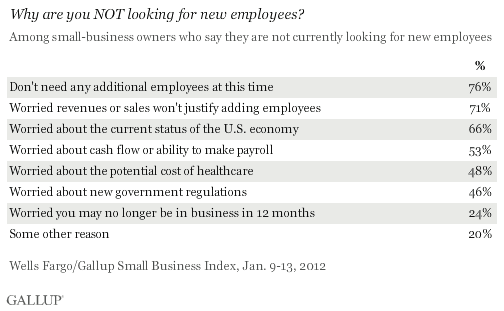

Why Aren’t Small Business Hiring ?

Source: Gallup

What's been said:

Discussions found on the web: