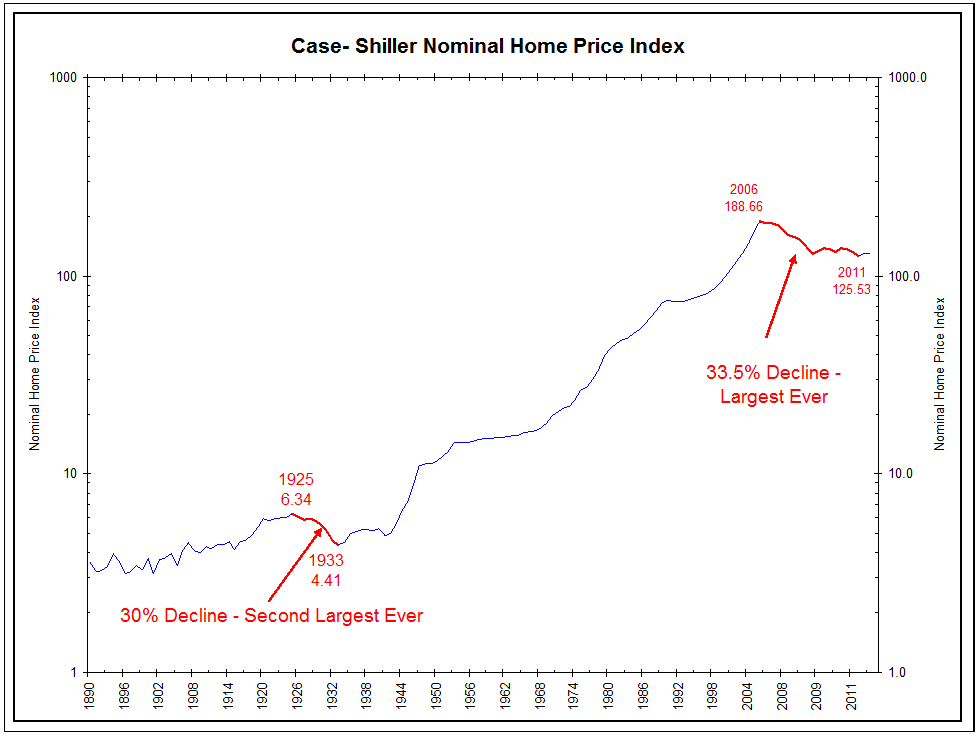

Click to enlarge:

>Source: Bianco Research

>

Happy Anniversary! Here we are, exactly 5 years to the day from the beginning of the credit crisis.

Jim Bianco dates the crisis as formerly beginning on February 8, 2007 when HSBC’s Household International announced huge losses due to subprime lending. HSBC had to restate its 2006 earnings significantly lower. Bianco adds that while most people were asking what a subprime loan was, HSBC was “patient zero” of the crisis.

To underscore this was indeed the start, HSBC ended this lending unit March 2009, literally hours before the stock market bottomed.

What's been said:

Discussions found on the web: