The National Federation of Independent Business (NFIB) released its monthly Small Business Economic Trends report this morning.

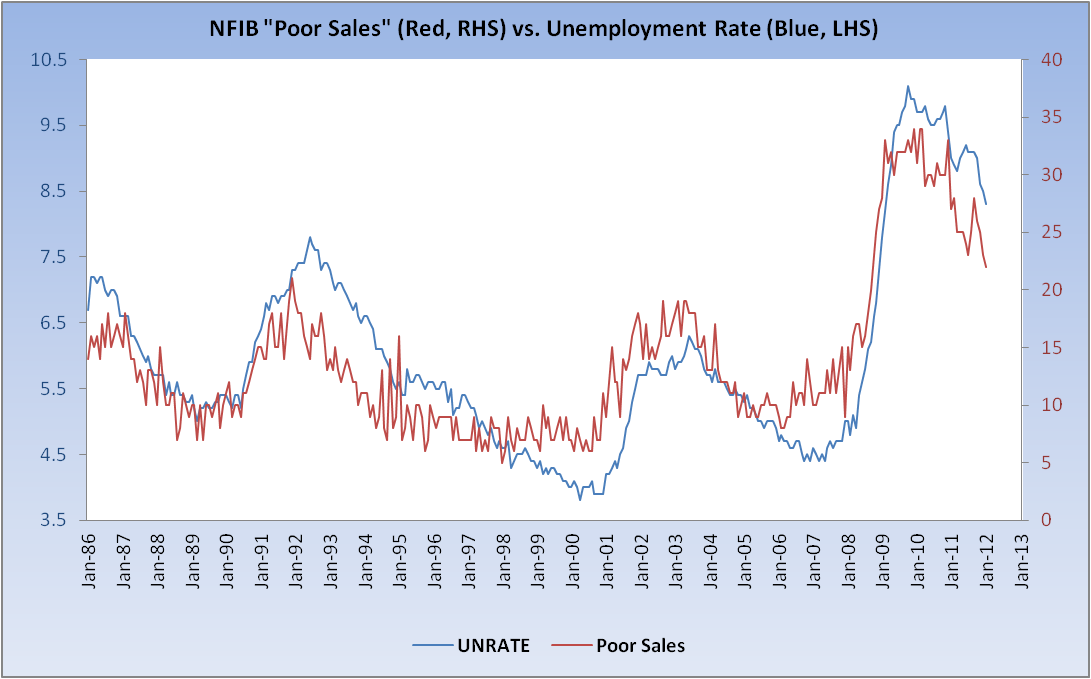

I’ve noted in the past that as an answer to the question, “What is your ‘single biggest problem,'” Poor Sales correlates very highly to the Unemployment Rate (0.88). Poor Sales ticked down again this month, from 23 to 22, and is down from 27 one year ago.

Glacial progress.

What's been said:

Discussions found on the web: