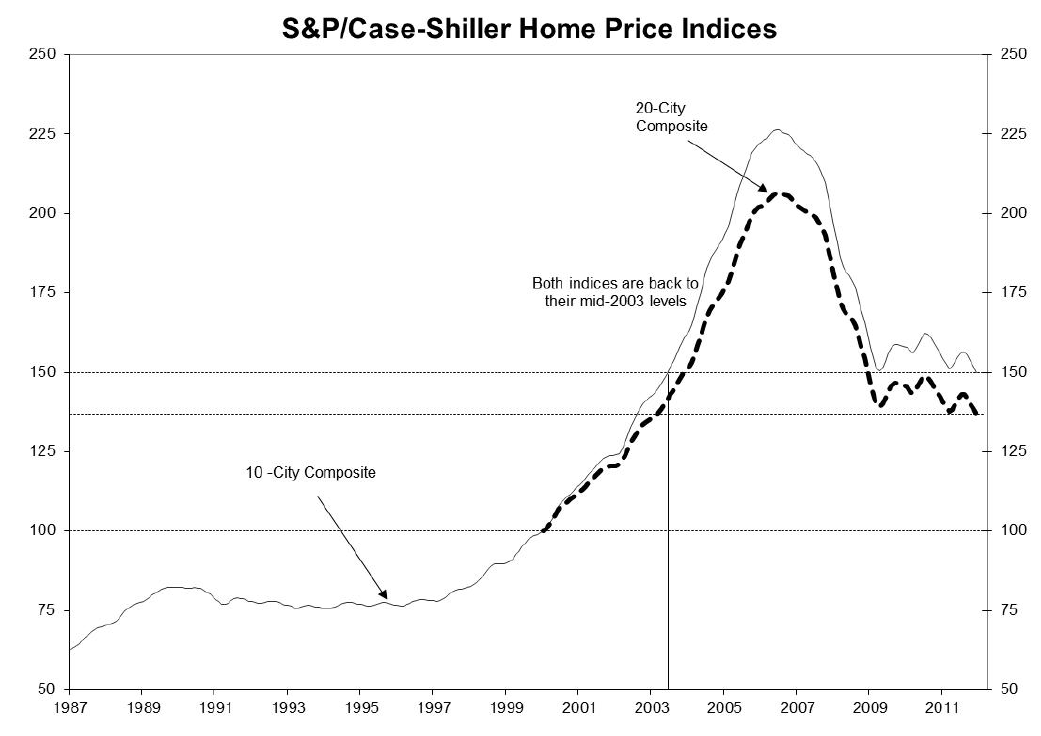

December 2011 Case-Shiller Home Price Indices showed that 2011 ended at new index lows.

The National Composite Index fell by 3.8% during Q4; year over year changes were down 4.0%. The 10- and 20-City Composites also fell by similar amounts, falling -3.9% and -4.0% versus December 2010, respectively.

>

more charts after the jump

˜˜˜

Source: S&P Indices

What's been said:

Discussions found on the web: