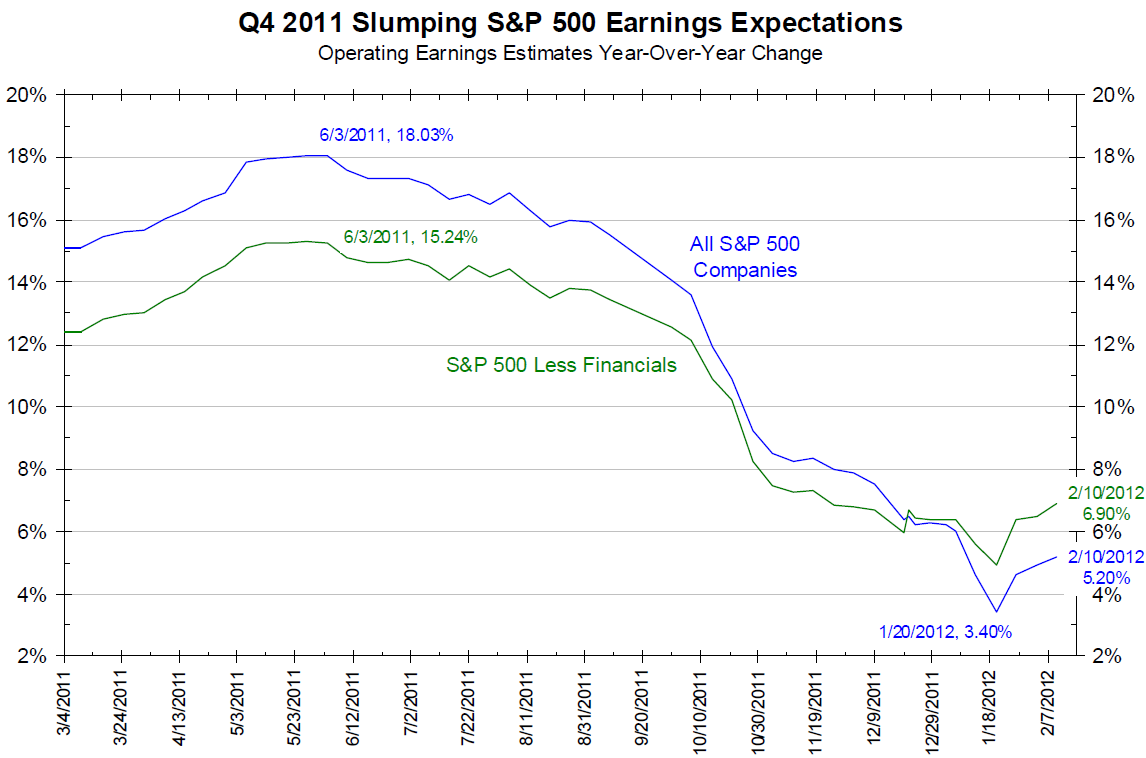

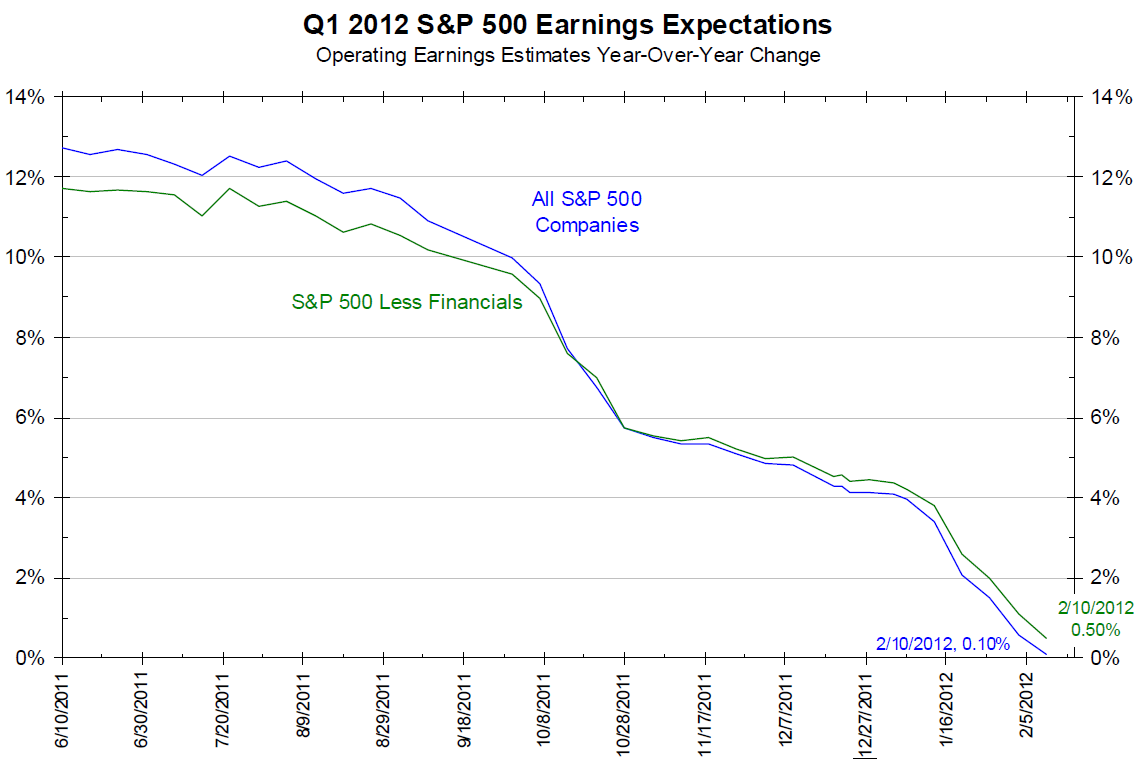

The 12-month forward estimates are not consistent with the short-term estimates. The first chart below shows that Q4 2011 earnings growth rates are estimated to be near 5.50% (370 actual earnings and 130 estimates are used to calculate this). This is consistent with what FactSet noted above. The second chart below shows Q1 2012 earnings estimates to be near 0%, also consistent with FactSet.

For the 12-month forward estimate (two charts above) to be correct, earning will have to boom starting in Q3. Analysts are predicting that, after a lackluster Q4 2011 and Q1 2012, earnings will indeed boom. This odd forecast had better come true, otherwise the 12-month forward earnings estimates, which are often used in valuation metrics, are not realistic.

Click to enlarge:

˜˜˜

Source:

Bianco Research

Charts Of The Week

February 15, 2012