Source: Bloomberg BRIEFs Economic Newspaper February 28, 2012

>

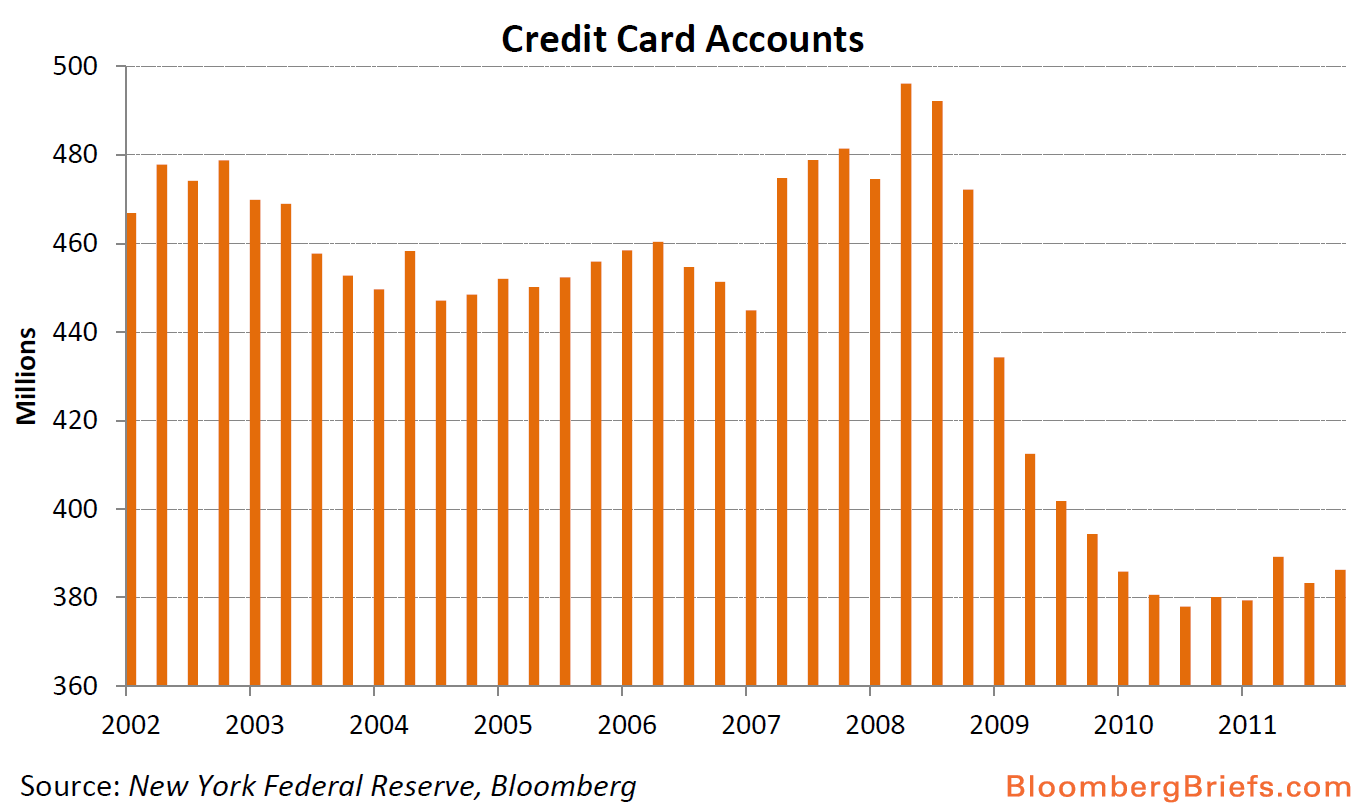

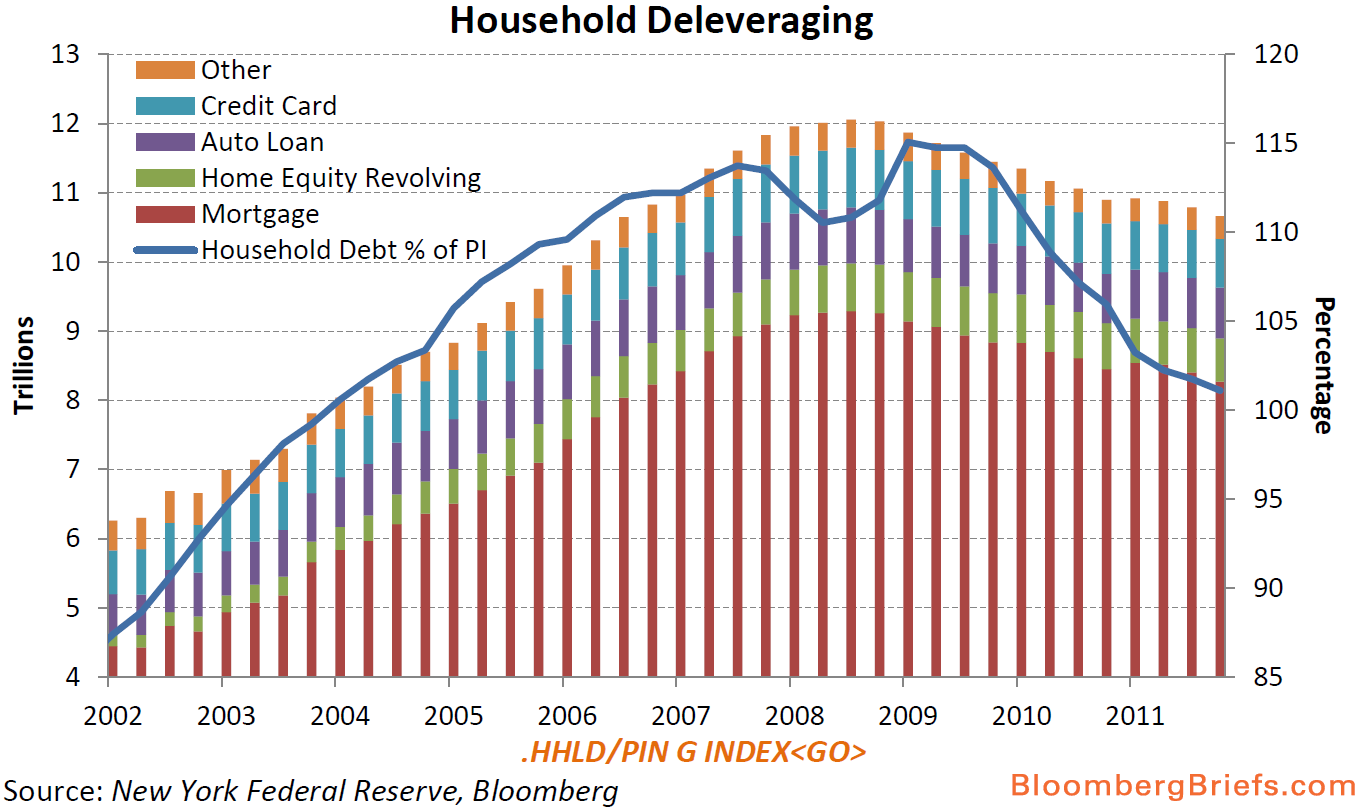

Why has the recovery been so weak? The short answer is Household Deleveraging. Its why post credit crisis recoveries are so much slower across the boards.

Deleveraging prevents the virtuous cycle from beginning. Less borrowing means less retail spending. That eventually bites into corporate profits, which ultimately means more modest CapEx spending and weaker hiring.

Which is pretty much what we have seen: Weak holiday retail sales, soft spending (other than Autos and Gasoline), mediocre (but improving) NFP, flat wages, mild inflation, ok GDP.

This is what a post credit crisis recovery is supposed to look like.

What's been said:

Discussions found on the web: