Some strategists are noting that the bounce in January was driven by lower quality names and sectors. Others are pointing out that the earnings picture continues to soften.

Merrill’s Equity Strategy group notes that Higher quality is still cheaper than lower quality, and that within large-cap stocks, high quality has traded at a significant P/E discount vs. low quality ever since the tech bubble.

The key, in their view, is the deleveraging cycle. They hypothesize that this anomaly with see valuations to converge. My view of the secular bear psychology is that frustrated investors become willing to spend less and less on a dollar of earnings, compressing ALL multiples.

In my perspective, the phenomena seems more psychology driven. Sure, issues like quality, deleveraging, cap size (as well a Euro troubles) are relevant, but they drive investors risk appetites.

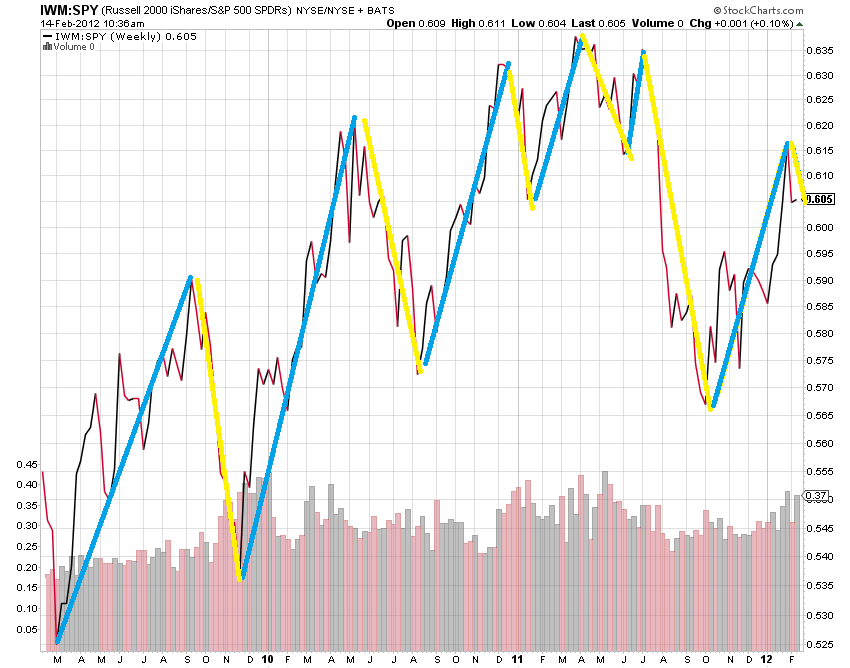

The factors above becomes more significant if and when earnings growth slows even more appreciably than the present quarter. In that environment, higher quality, larger firms become more (not less) favored. We have seen that begin recently.The chart below showing the ratio of Russell 2000 small caps versus S&P500 large caps epitomizes this.

Look at the chart below. The periods where small caps are outperforming their larger brethren are depicted as blue lines. larger cap out performance are the yellow lines. The big caps seem to do better when the rally loses steam (Sept-Dec 09); when the market softened before QE2; and again before Operation Twist.

In other words, the Risk On, Fed-liquidity driven trading. Left to its own devices, the market seems to be softening as the economy stumbles along.

The Fed’s emphasis on making “cash = trash” is what is driving small caps and lower quality names.

>

Russell 2000 Small Caps versus S&P500 Large Caps

>

Merrill’s strategist notes that “As corporate profit growth decelerates, quality tends to win out” and on a relative basis, I agree. On absolute basis, quality may simply fall less than momentum names. Not exactly a place to hide from the storm — just a place to get less beat up . . .

What's been said:

Discussions found on the web: