>

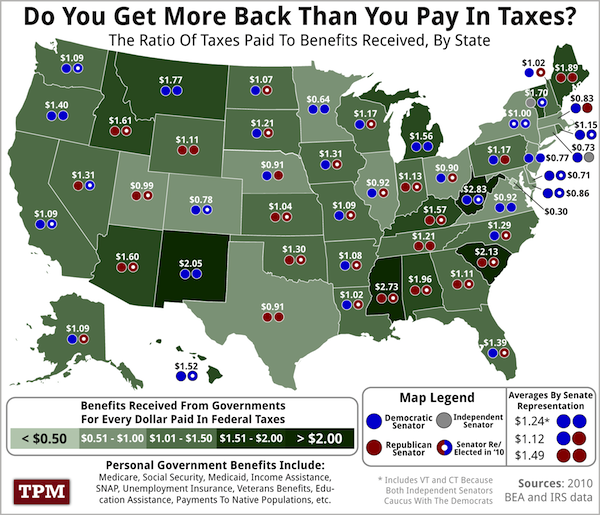

For each $1 paid in Federal taxes, how much does your state receive? (Political orientation approximated by the parties of states two Senators).

This is done on a per state basis, I’d like to see the data depicted on a per capita basis as well — both the paying and the receiving.

>

Source:

Red Staters Use The Safety Net Too

BRIAN BEUTLER

TPM, FEBRUARY 22, 2012

http://tpmdc.talkingpointsmemo.com/2012/02/the-map-that-proves-red-staters-use-the-safety-net-too.php

What's been said:

Discussions found on the web: