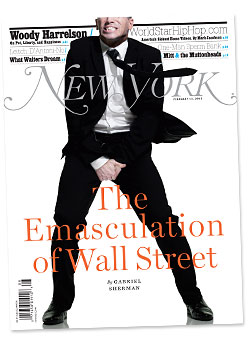

This week’s New York magazine — a non Business publication — has a rather bearish cover discussing “The Emasculation of Wall Street.

This week’s New York magazine — a non Business publication — has a rather bearish cover discussing “The Emasculation of Wall Street.

Last week, I mentioned the Barron’s cover was somewhat bullish, with the caveat that Barron’s is a business weekly. New York magazine is more general interest — its not Time or Newsweek, because it covers Wall Street in its back yard.

Meanwhile, Bloomberg is out with this headline today: Investors Fearful as Stock Rally Best Since 1987.

Still, I suspect the NY Mag cover is a bullish sentiment indicator.

>

Source:

The End of Wall Street As They Knew It

Gabriel Sherman

NY, Feb 5, 2012

http://nymag.com/print/?/news/features/wall-street-2012-2/

What's been said:

Discussions found on the web: