My train reading:

• Europe May Be Planning 1.5 Trillion Euro Backstop Fund (Spiegel.de) versus Hedge Funds Brace for Euro Zone Break-Up (NYT)

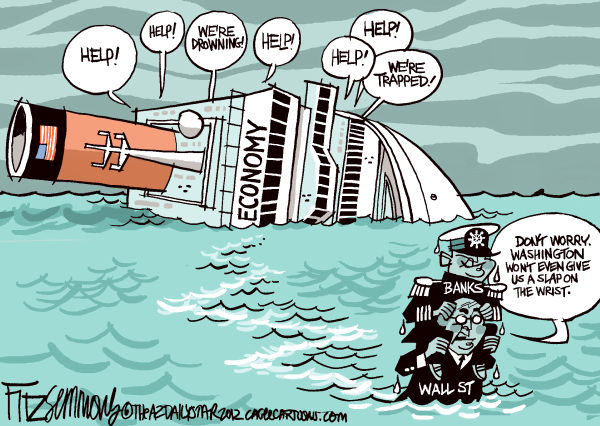

• This is HILARIOUS: SEC Enforcement Actions (Securities and Exchange Commission)

• Why use an advisor? Scapegoats and Trigger Men (The Reformed Broker)

• The Man Who Fired Greenspan (Naked Capitalism)

• Fed Two-fer:

…..-I Don’t See How This Can Continue (Tim Duy’s Fed Watch)

…..-Consumer Saving is not Usually a Bad Thing (Bob McTeer’s Blog)

• Facebook’s IPO will be way overvalued (Market Watch)

• Where Would We Be Without Apple & CAT? (WSJ) see also An Apple TV set in 2012? (Fortune)

• To Colleagues: I’m Outta Here (WSJ)

• CBS Greenlights Comedy From Louis C.K., Spike Feresten (Hollywood Reporter)

• Even CEO Can’t Figure Out How RadioShack Still In Business (The Onion)

What are you reading?

>

What's been said:

Discussions found on the web: