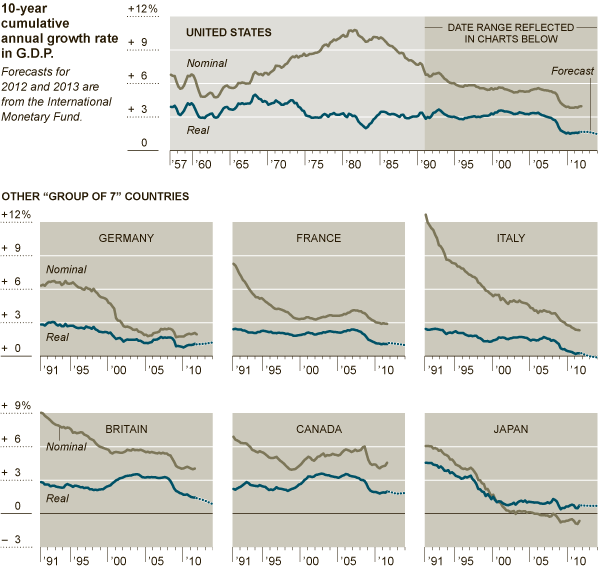

Floyd Norris explains why the picture for Global Growth has been disappointing:

“United States economy has been growing at its slowest rate since the Great Depression. Most other major developed countries have also experienced unusually slow growth over the last 10 years.

The American economy’s reported 2.8 percent growth in the fourth quarter, at an annual rate, was seen as mildly encouraging. But it meant that over the previous 10 years, the economy had grown at a compound annual rate of just 1.7 percent. Until the current cycle, there had been no similar prolonged period of slow growth since the Depression.”

Charts below reflect the IMF forecasts of 1.8% real growth in 2012 and 2.2% in 2013. For the US, the past decade will have fallen to 1.5%. This is well below trend for any prior 10-year American period — but still above the 0.9 percent compound growth rate in the decade from 1929, the year the Depression began, to 1939.

>

>

Source:

A Bleak Outlook for Long-Term Growth

FLOYD NORRIS

NYT, February 3, 2012

http://www.nytimes.com/2012/02/04/business/a-long-term-slide-in-growth-for-industrialized-economies.html

What's been said:

Discussions found on the web: