Source: WSJ

>

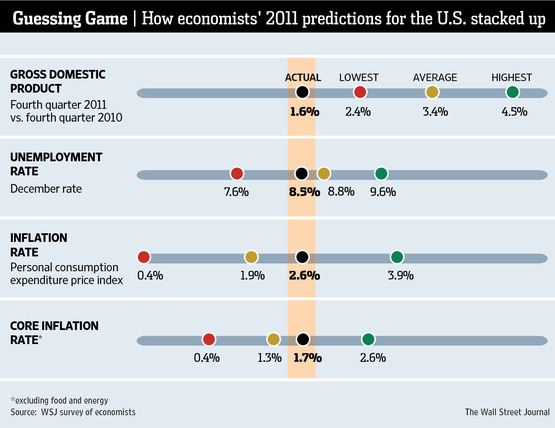

Surprise! The WSJ reports that Economists are bad at forecasting:

Simply put, 2011 was a terrible year for economic prognostication. With seemingly no end of overseas disasters — natural and man-made — to throw off experts’ predictions, it’s hardly surprising that this year’s winning score would only have been good for 35th in last year’s rankings.

>

Source:

Why Did Economists Get It So Wrong in 2011?

Ben Casselman

Real Time Economics February 13, 2012

http://blogs.wsj.com/economics/2012/02/13/why-did-economists-get-it-so-wrong-in-2011/

Rosier View Has Familiar Ring

BEN CASSELMAN and PHIL IZZO

WSJ, FEBRUARY 13, 2012

http://online.wsj.com/article/SB10001424052970203824904577215143354029590.html

What's been said:

Discussions found on the web: