We’re baffled anybody still looks to the U.S. bond market for signals of future economic activity, inflation, or even risk aversion. Case in point is today’s 7-year bond auction, which CNBC’s Rick Santelli rated an eleven on a scale of ten, i.e., a slam dunk!

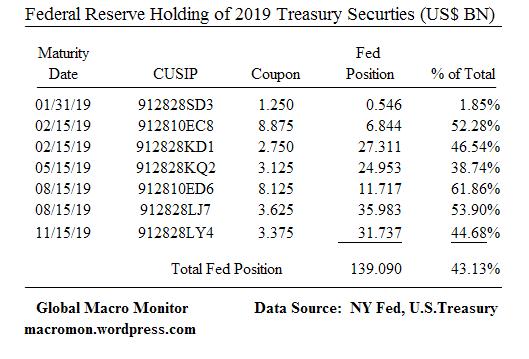

Go no further, however, than the chart below to see which maturities on the yield curve are the most repressed. Prior to today’s auction, for example, the Fed owned 43 percent of all Treasury coupon securities maturing in 2019 and more than 50 percent in three of the seven issues maturing in that year.

Yesterday we caught PIMCO’s very bright and articulate Mohammad El –Erian promoting the “seven-year bucket” in an interview with CNBC,

…make sure you have some gold, some oil, and concentrate your bond exposure in the five to seven-year bucket.

Known for “Fed Surfing” or getting in front of, or riding along with, the U.S. central bank’s market interventions, don’t you think PIMCO likes the seven-year, in part, because that is where Mr. Bernanke is camped out? Front running the Fed has paid handsomely for many and we doubt it is fully dominated by macro views of inflation, economic growth, Chinese hard landings, or risk aversion.

The information we divined from today’s successful bond auction? Especially, in a maturity that has been gagged and bound by Fed intervention? Absolutely nuttin’!

Finally, we view long-term Treasury interest rates as one of, if not, the most important price in the world. Because of direct financial repression the information it now provides and the signal it sends, which is so important to capital allocation decisions, has, at best, been severely distorted. No wonder corporations are hoarding cash and reluctant to invest.

Click chart to enlarge and for better resolution.

What's been said:

Discussions found on the web: