Some interesting reads to start your morning:

• Wall Street Bonus Withdrawal Means Trading Aspen for Coupons (Bloomberg)

• Q&A: What’s Going on With Gasoline Prices? (MoJo)

• Fed Shrugged Off Warnings, Let Banks Pay Shareholders Billions (ProPublica)

• Economy Picks Up Pace, but Risks Remain (WSJ) see also Surprise! The Case for QE3 Is Stronger Than Ever (The Atlantic)

• The Ben Bernanke Congressional Variety Hour (MarketPlace)

• A Call for Beijing to Loosen Its Grip on the Economic Reins (NYT)

• The Media Did Not Hype Fukushima (New Yorker)

• Twitter, the Startup That Wouldn’t Die (Businessweek)

• Economics: A Million Mutinies Now (The American)

• Nassim Taleb’s Big Idea: Transforming Debt Into Equity (The Trader)

What are you reading?

>

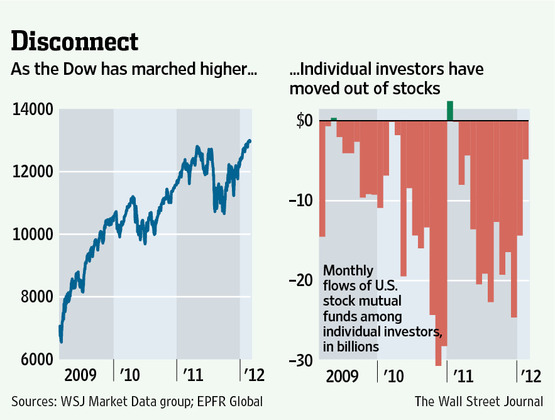

Investors’ Sell Signal: Surging U.S. Stocks

Source: WSJ

What's been said:

Discussions found on the web: