My morning reading material:

• Paving Path to Fraud on Wall St. (NYT) see also More Than Culture Shifted On Wall Street (WSJ)

• Is the end of the gold bull is on the horizon? (Marketwatch)

• Why quantitative easing is the only game in town (FT.com)

• The High Cost of Low Interest Rates (The Fiscal Times)

• Why Some Countries Go Bust (NYT Magazine)

• Buffett Awards Wall Street-Sized Pay Praised by Dimon (Bloomberg)

• End Of An Error: The Car Century Begins To Wane (TPM)

• A Patent Lie: How Yahoo Weaponized My Work (Wired)

• iPad (3) (Daring Fireball)

• Eric Kandel’s Visions: What is Nobel-winning neuroscientist (who spent most of his career fixated on the generously sized neurons of sea snails) doing lecturing us on art history? (The Chronicle)

What are you reading?

>

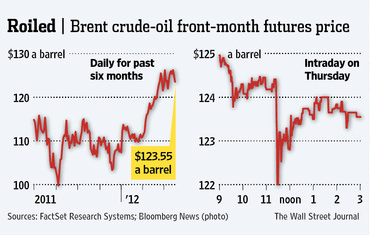

A Strategic Oil Leak

Source: WSJ

What's been said:

Discussions found on the web: