My morning reading material:

• Your Financial Adviser Might Be a Lemon (Time) see also Why Wall Street Hates the Lazy Portfolios Strategy (SmartMoney)

• The Real Oil Shock (NYT)

• Large Hedge Funds Fared Well in 2011 (DealBook) see also Is Wall Street Full of Psychopaths? (The Atlantic)

• Why Ben Bernanke isn’t declaring victory for America’s economic recovery (Telegraph)

• Who Captured the Fed? (Economix)

• Marx at 193 (London Review of Books)

• The End Is Coming: January 1, 2013 (Businessweek)

• Grim Housing Data Shows We Have Not Hit Bottom (The Fiscal Times)

• Apple’s War on Android (Businessweek) but see Google Heightens Rivalry With iPad (WSJ)

• Supreme Court and the National Conversation on Health Care Reform (Economix)

What are you reading?

>

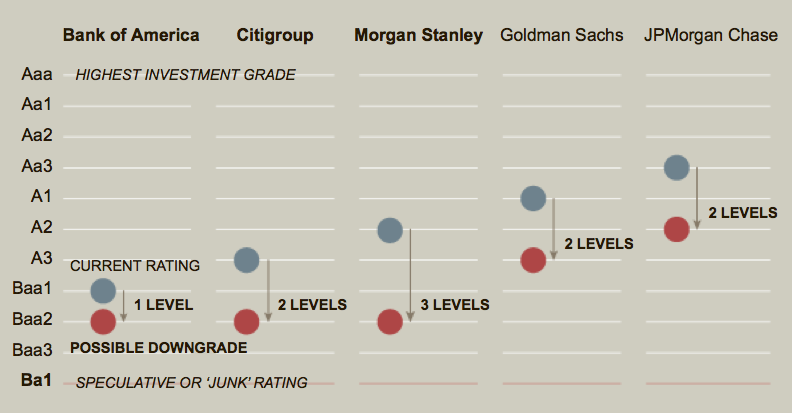

Moody’s Ratings of Banks’ Debt

Source: NYT

What's been said:

Discussions found on the web: