My morning reads:

• Blog War: Howard Lindzon Says Timothy Sykes is a Cancer…A Malignant Tumor of the Web (Howard Lindzon)

• Triple trouble in Europe, US and China brings out the bears (Telegraph)

• Re-Examining that “Massive Stimulus” (EconBrowser) see also Fed Move Likely by June, Ex-Insider Says (Barron’s)

• Caroline Baum: Beware Analysts Torturing Jobs Data to Fit Model: (Bloomberg)

• Apple Leading Charge in all-ETF 401(k) Plans (ETF Guide)

• Japan Nuclear Shutdowns Boost Current Account Deficit to Record $5 Billion (Bloomberg)

• Cost of Gene Sequencing Falls, Raising Hopes for Medical Advances (NYT) see also Gorilla genome analysis reveals new human links (Guardian)

• Tablet by Any Other Name Not as Sweet as ’iPad’ (Bloomberg) see also Apple ready to tackle television with its new iPad (Washington Post)

• In pictures: Rallies after Putin wins Russia election (BBC)

• Jon Stewart Interviews Bruce Springsteen for Rolling Stone (Rolling Stone)

What are you reading?

>

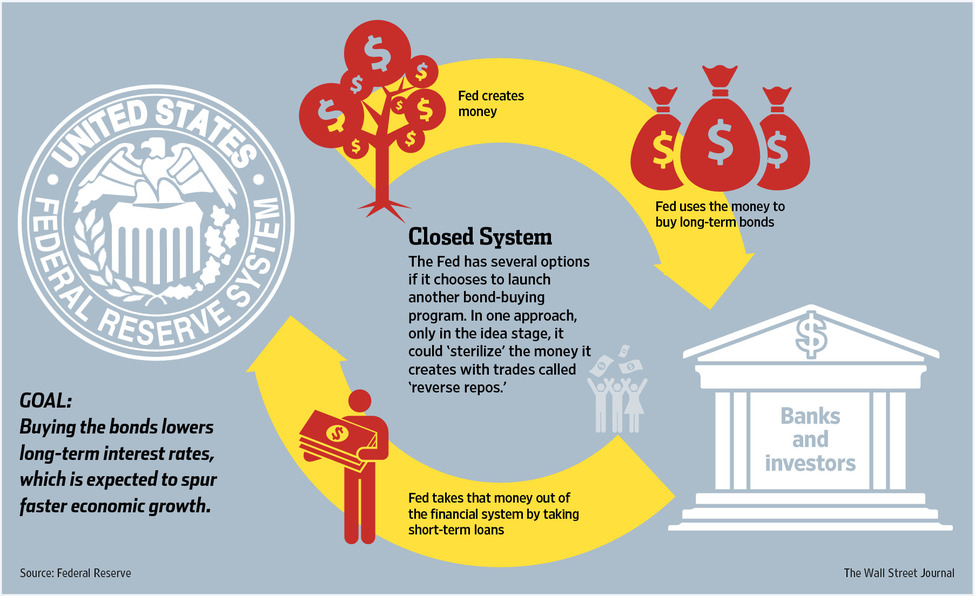

‘Sterilized’ Bond Buying an Option in Fed Arsenal

Source: WSJ

What's been said:

Discussions found on the web: